MicroStrategy Continues Accelerating Bitcoin Purchases

Accelerating Bitcoin Purchases: In a bold display of its unwavering confidence in Bitcoin, MicroStrategy, the global leader in enterprise analytics software, has been rapidly expanding its cryptocurrency holdings. Since making its first purchase in August 2020, the company has consistently made headlines by doubling down What is Bitcoin Cash—How Does BCH Work? on Bitcoin as a key component of its corporate strategy.

The Strategy Behind the Moves

MicroStrategy’s aggressive acquisition of Bitcoin is deeply rooted in its founder and Executive Chairman Michael Saylor’s belief in the cryptocurrency’s long-term potential as a hedge against inflation and a superior store of value. According to Saylor, traditional cash reserves lose value over time due to inflation, whereas Bitcoin’s fixed supply and decentralized nature offer a unique opportunity for wealth preservation.

This philosophy has led MicroStrategy to convert significant portions of its cash reserves into Bitcoin, viewing it as an asset that aligns with the company’s long-term vision. “Bitcoin is digital gold,” Saylor has often remarked, emphasizing its role in the digital economy of the future.

Accelerated Purchases: The Numbers

As of late 2024, MicroStrategy holds over 150,000 BTC, worth billions of dollars at current market prices. Recent filings reveal that the company has been purchasing Bitcoin at an accelerated pace, often taking advantage of market dips to bolster its position. By issuing debt and equity to fund these acquisitions, MicroStrategy has demonstrated its willingness to take bold financial steps to secure its Bitcoin reserves.

As of late 2024, MicroStrategy holds over 150,000 BTC, worth billions of dollars at current market prices. Recent filings reveal that the company has been purchasing Bitcoin at an accelerated pace, often taking advantage of market dips to bolster its position. By issuing debt and equity to fund these acquisitions, MicroStrategy has demonstrated its willingness to take bold financial steps to secure its Bitcoin reserves.

In its most recent quarterly report, the company disclosed additional purchases worth hundreds of millions of dollars, highlighting its commitment to Bitcoin despite market volatility. This strategy, while ambitious, has sparked both admiration and criticism from industry analysts and investors.

Impacts on MicroStrategy’s Financials

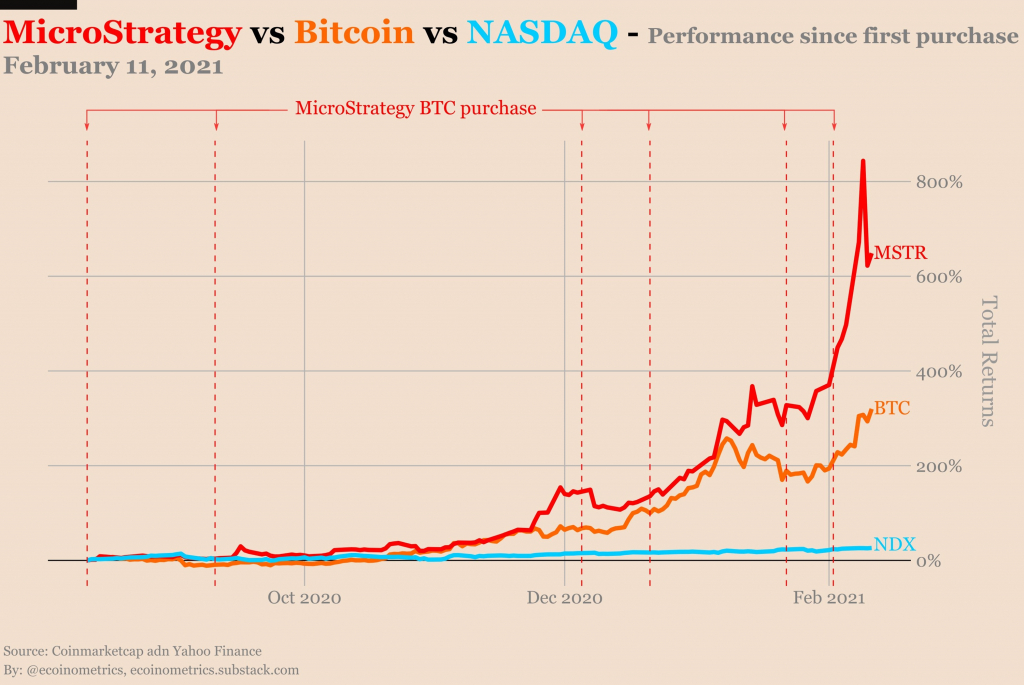

MicroStrategy’s Bitcoin strategy has had a profound impact on its financial performance and market perception. On one hand, the value of its Bitcoin holdings has significantly appreciated since the initial investments, contributing to an increase in shareholder value during Bitcoin’s bull runs. On the other hand, the company’s stock price has become highly correlated with Bitcoin’s price movements, exposing it to heightened volatility.

Critics argue that this approach increases financial risk and deviates from the company’s core business. However, supporters counter that MicroStrategy’s forward-thinking strategy positions it as a pioneer in integrating Bitcoin into traditional corporate finance.

The Broader Implications for Bitcoin

MicroStrategy’s ongoing Bitcoin acquisitions have ripple effects across the broader cryptocurrency ecosystem. By consistently demonstrating institutional confidence in Bitcoin, the company has paved the way for other corporations and institutional investors to explore similar strategies. Its actions also contribute to the growing perception of Bitcoin as a legitimate asset class, further driving adoption and integration.

Conclusion

As MicroStrategy continues to accelerate its Bitcoin purchases, the company’s approach will likely remain a focal point in discussions about corporate treasury management and Bitcoin adoption. While the strategy carries inherent risks, it also underscores the transformative potential of cryptocurrencies in reshaping traditional financial paradigms.

Whether this bold gamble will yield long-term success for MicroStrategy remains to be seen. However, one thing is certain: the company’s commitment to Bitcoin is unwavering, Accelerating Bitcoin Purchases solidifying its reputation as one of the most prominent advocates of cryptocurrency in the corporate world.

[sp_easyaccordion id=”3736″]