XRP Trading Surge Institutional Interest and Market Sentiment

Despite opposition around the US$2.30 mark, XRP, the native bitcoin of Ripple Labs, has lately seen a notable increase in trading volume, hitting hitherto unheard-of levels. Both traders and experts have become interested in this phenomena since it begs issues regarding the causes of the higher activity and possible consequences for the price movements of XRP.

XRP Trade Surge

XRP’s trade volume on Coinbase has surged shockingly 9,640%, to about $438 million, over the past 24 hours. This sharp rise shows traders and investors’ increasing curiosity in XRP, implying that market players are actively interacting with the asset in spite of price resistance.

This increase in trading activity is not a one-off occurrence. XRP has experienced a notable surge in trading activity across main exchanges; open interest rises by 37% in just 24 hours, equating to $4 billion. Such large trade volumes sometimes precede notable price swings, suggesting that XRP might be about to overcome its present resistance levels.

Drivers of XRP Surge

A number of elements help to explain the current XRP trading volume surge:

Institutional Interest

The rising trading activity is much influenced by the growing interest of institutional investors. The possible release of XRP depository receipts (DRs) has drawn conventional investors looking for XRP exposure without actually buying the coin. These DRs are supposed to be held by controlled companies, which offers a compliant way for institutional investment.

Market Sentiment

Broader market attitude has also helped to explain the XRP trading volume explosion. Positive events that have inspired investor hope include 21Shares’ XRP Exchange-Traded Fund (ETF) application. An ETF would provide investors with easily available, regulated access to XRP, therefore stimulating demand and maybe bigger trading volumes.

Regulatory Developments

Recent legislative changes—including the retirement of SEC Chairman Gary Gensler—have made the environment more suitable for cryptocurrencies. These events have lessened uncertainty and pushed both institutional and retail investors to raise XRP stakes.

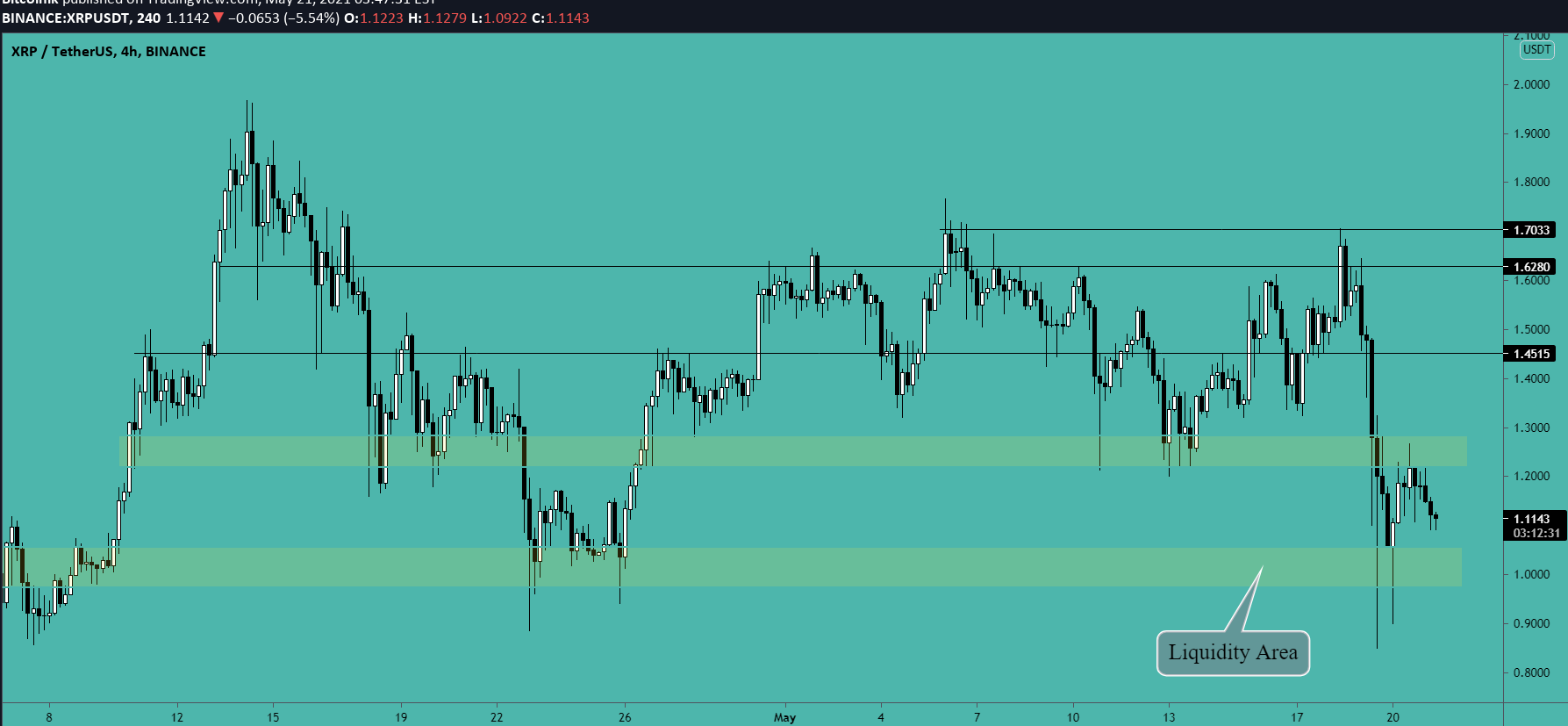

XRP Trading Resistance

Despite the surge in trading volume, XRP faces significant resistance around the US$2.30 level. This price point has proven challenging to surpass, with XRP briefly breaking through to reach US$2.39 but struggling to maintain momentum above this threshold. The inability to sustain prices above US$2.30 suggests that market participants are cautious, awaiting further developments before committing to higher price levels.

Analysts caution that while the increased trading volume is a positive indicator, it also brings heightened volatility. The rapid influx of trades can lead to sharp price fluctuations, and traders should be prepared for potential corrections. Historical data indicates that similar surges in trading volume have sometimes been followed by short-term pullbacks, emphasizing the need for careful risk management.

Final thoughts

For traders and investors, the present XRP rise in trading volume combined with the barrier at US$2.30 creates a challenging situation. Although the higher activity points to great interest and possibility for upward development, the degree of resistance shows that market players are acting sensibly.

Looking ahead, the main things to keep an eye on are institutional interest continuing, XRP DRs and ETF approval and launch, and more legislative changes. Should these elements line up perfectly, XRP might surpass its present obstacle and show continuous increasing momentum. On the other hand, any negative development would cause more volatility and possible market corrections.

Finally, XRP’s recent increase in trading volume despite the $2.30 opposition highlights the growing interest and possible value of the cryptocurrency. Even if obstacles still exist, the changing terrain offers traders and investors paths to negotiate. As always, capitalizing on the possibilities given by XRP’s market dynamics will depend mostly on thorough analysis and risk control.