World Liberty Ethereum Finance has doubled its ETH holdings in a week. The analytics platform reports that the project’s ETH holdings have surged 180% over the past few days, from around 2,200 ETH on Monday to more than 7,000 by Thursday.

Arkham reports that Ethereum is World Liberty’s largest holding, with 7,094 ETH worth around $16.2 million.

World Liberty Holdings in Red

On March 6, Arkham alerted users that World Liberty Financial had just sent $25 million in USDC to a separate contract, which purchased $10 million in ETH and $10 million in wrapped Bitcoin (WBTC), and $1.5 million in a token called MOVE. MOVE is the native token of the Movement Network, a venture capital-backed blockchain programming language that facilitates EVM (Ethereum Virtual Machine) compatibility. The token skyrocketed 26% over the past few hours as the Trump DeFi platform loaded up.

However, the nine tokens purchased by World Liberty are currently in a total loss of $89 million, reported Lookonchain on March 6. Much of this is due to the impact of Trump’s trade tariffs on crypto markets. In addition to ETH, WBTC, and USDT, World Liberty also holds 40 million Tron (TRX) tokens worth $10 million, 10 billion WhiteRock (WHITE) tokens worth $3.4 million, and a handful of more obscure tokens such as ONDO, COLLE, GROK, and HOPPY.

Ethereum remains the industry standard for DeFi, with a 52.6% market share of total value locked, according to DeFiLlama. However, it has lost some ground to Solana recently, which has seen its DeFi market share increase to 8.4% with a TVL of $9 billion. Solana took a massive hit recently as the meme coin bubble burst because the network was primarily used to mint and trade the tokens.

ETH Price Reaction

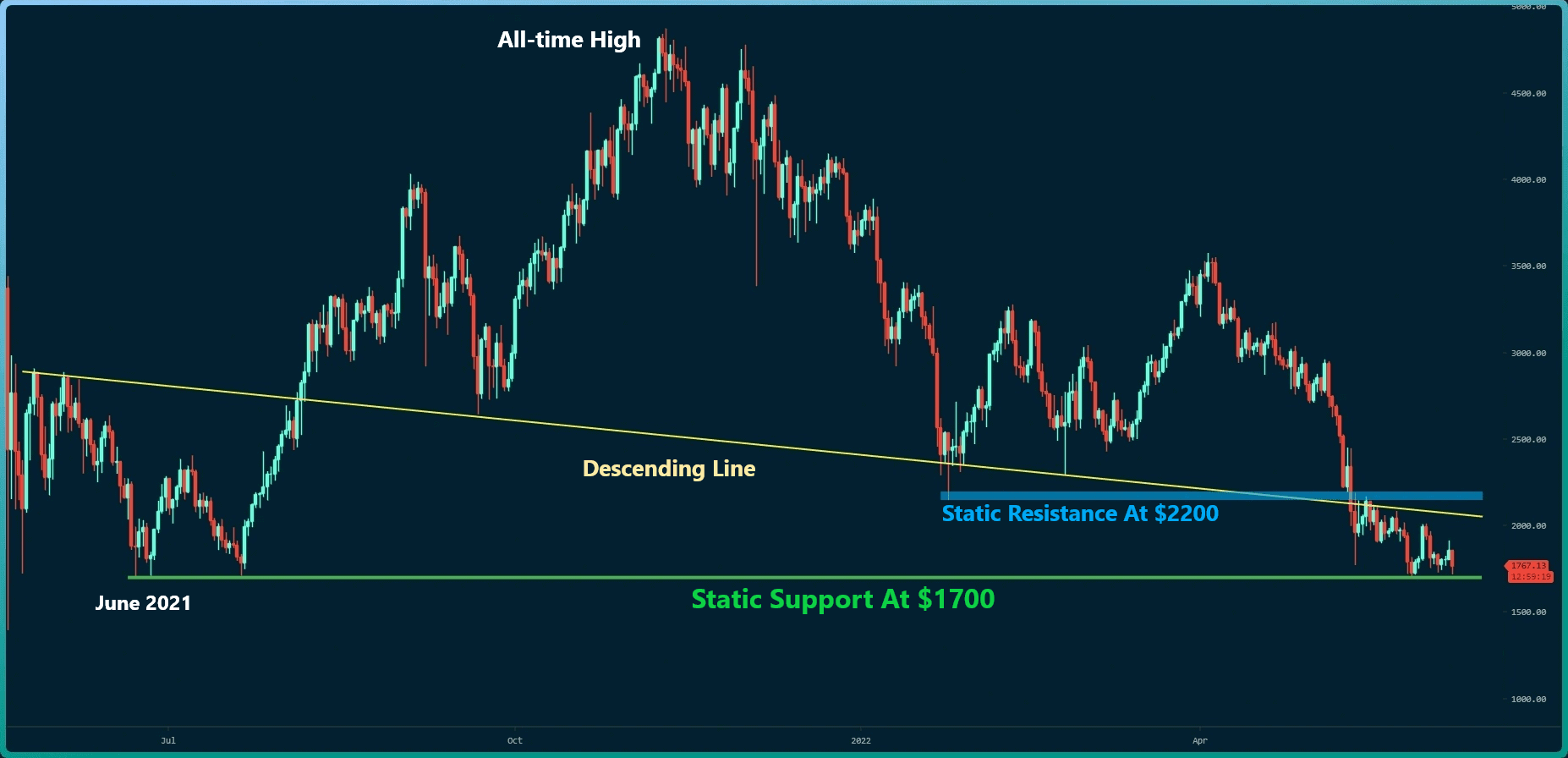

ETH has woken up over the past 12 hours, gaining just over 6% to reclaim $2,300 during Asian trading on Thursday. Nevertheless, the asset fell to a 16-month low of just over $2,000 earlier this week when analysts warned of a huge collapse in ETH prices if the head and shoulders chart pattern breaks down. ETH appears to have bounced off support and is edging higher, though it remains down 16% over the past fortnight.

Could you clarify what you’re asking about Ethereum’s (ETH) price reaction? Are you referring to its current price movement, a specific event that caused a price change, or something else? Let me know how you’d like to approach it.

Final thoughts

The article highlights World Liberty Finance’s significant increase in Ethereum (ETH) holdings, which surged from around 2,200 ETH to more than 7,000 ETH within just a few days. This aggressive move suggests the company is bullish on Ethereum. However, the sudden shift raises questions about their underlying strategy and market outlook, especially considering the broader volatility in crypto markets.

In addition to ETH, World Liberty has expanded its portfolio to include wrapped Bitcoin (WBTC), MOVE (a token associated with the Movement Network), and other assets like TRX and WhiteRock (WHITE). This diversification reflects their interest in various blockchain ecosystems and exposes them to potential risks from these different assets, each with its own volatility.

The article also mentions the influence of external factors, such as Trump’s trade tariffs, on the crypto markets. This serves as a reminder that crypto is still highly susceptible to geopolitical and macroeconomic forces, despite its decentralized nature. Meanwhile, Ethereum’s price action has been tumultuous, dipping below $2,000 before recovering to around $2,300. This price fluctuation highlights the ongoing uncertainty in the market, though the bounce back from its lows indicates that ETH still has intense support levels. The 16% drop over the past two weeks suggests that Ethereum, like the broader market, is navigating a period of instability.

Leave a Reply