Solana price decline Solana sol-7.32% Solana, one of the top crypto markets, has plunged to $138, down by 53% from its highest level this year. This crash has coincided with the ongoing woes in its ecosystem, as most meme coins have plunged. CoinGecko data shows that all Solana meme coins’ market cap crashed from over $25 billion in January to $7.6 billion—official Trump-4.46 % Official Trump. The most significant Solana meme coin has dropped by 10% in the last seven days, giving it a market cap of $2.4 billion.

Other meme coins, such as Bonk, Dogecoin, Pudgy Penguins, and Fartcoin, have all slipped by over 20% in the last seven days. Notably, only the Official Trump meme coin has a market cap of over $1 billion. Solana meme coins have become toxic assets after some high-profile blow-ups in the past few weeks.

The prospects of being included in President Donald Trump’s crypto stockpile have not boosted the Solana price. A polymarket poll with $301,000 in assets shows that the odds of a Strategic Solana Reserve have dropped to just 25% from over 40% earlier this month. These odds have jumped to 86% on Polymarket.

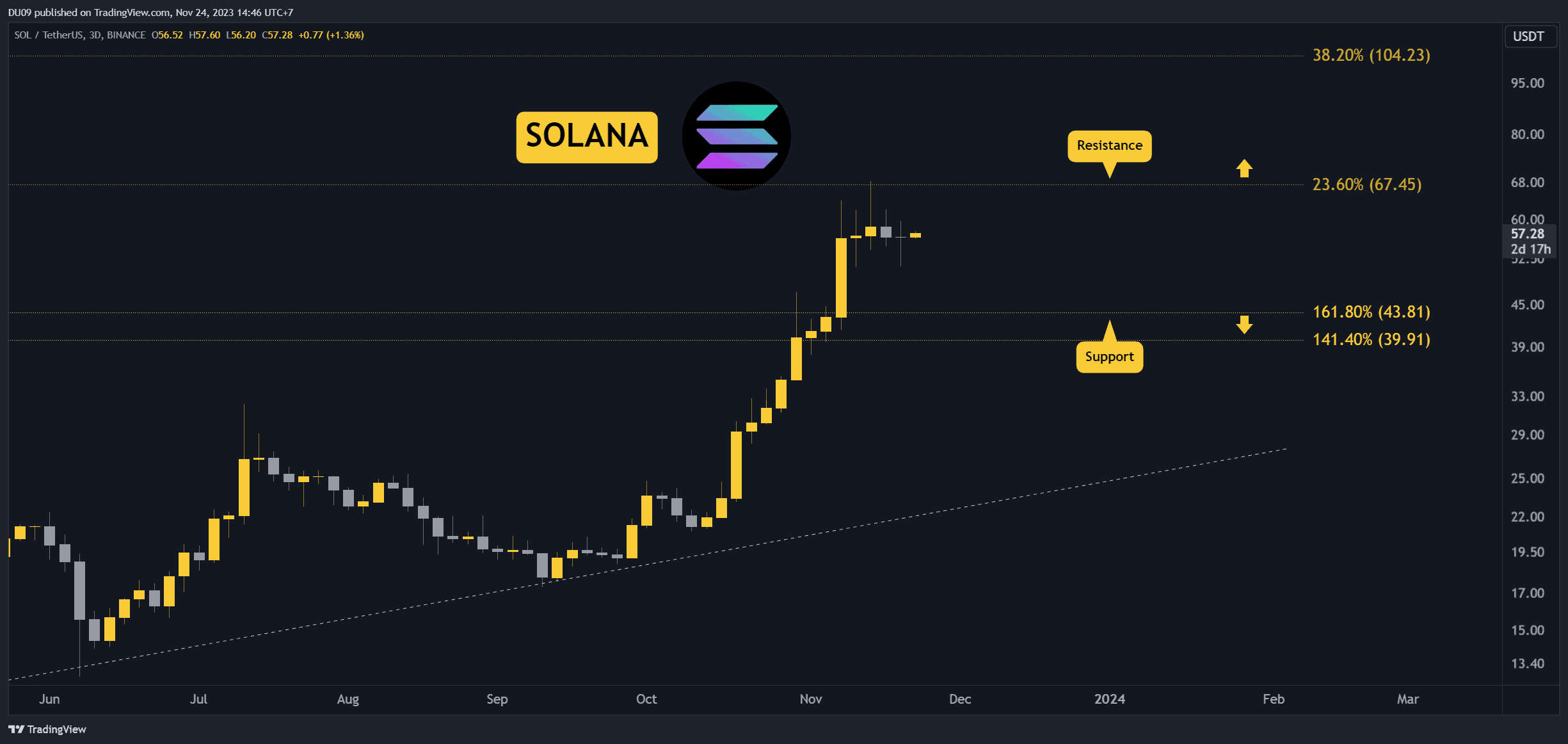

Solana (SOL) Price Analysis

The daily chart shows that the SOL price has steeped downward in the past few months. It has plunged from near $300 to $140 today. SOL crashed below the ascending trendline that connects the lowest swings since August last year. It also moved below the key support level at $170, the lowest swing on Jan. 13, and the neckline of the double-top pattern.

It has also formed a death cross pattern as the 50-day and 200-day moving averages have flipped each other. Therefore, the coin will likely continue falling, with the next target level being the psychological point at $100.

Solana’s Appeal for Meme Coins

Solana was launched in 2020 by Anatoly Yakovenko, a former Qualcomm engineer, and co-founders Greg Fitzgerald and Raj Gokal. Its blockchain was designed to offer high throughput low transaction costs and fast processing speeds using a unique consensus mechanism called Proof of History (PoH) combined with Proof of Stake (PoS).

Meme coins thrive on their blockchain for a few key reasons. This makes it affordable for developers to launch tokens and for users to trade them frequently, which is ideal for meme coins’ speculative and often high-volume trading nature. It can process thousands of transactions per second, which ensures liquidity and minimizes slippage during trading, attracting meme coin enthusiasts who usually chase rapid gains.

This ease of deployment encourages quick launches of meme coins, often with minimal effort. These factors combined make Solana a popular choice for launching meme coins, despite the space’s risks of volatility and scams.

Final thoughts

This article presents a mixed picture of Solana’s current market landscape, indicating problems and promising possibilities. Solana’s price declined to $138. This, combined with the unprecedented drop in Solana-based meme coins’ market cap, means a massive storm within the system—the meltdown of meme coins such as Official Trump and Libra. The general downward slide in Solana’s market cap implies that investors are getting more cautious. They are especially cautious in the unpredictable space of meme coins.

Solana seems to be at a juncture, caught between the wreckage of meme coin crashes and the potential for recovery through institutional acceptance or more extensive use cases. Investors are becoming increasingly wary. Solana’s future may depend on whether it can escape the meme coin mess and exhibit more long-term growth.

Leave a Reply