Ethena ENA Investment Analysis Navigate Token Unlocks and Market Volatility

The cryptocurrency market enters August 2025 with heightened attention on Ethena (ENA), particularly as the protocol faces a significant milestone with its scheduled token unlock event. This comprehensive Ethena ENA investment analysis examines the current market dynamics, recent protocol developments, and strategic investment considerations for both short-term traders and long-term investors.

Recent market data shows ENA price surged 13% to $0.622, with trading volume increasing 28% to $1.14 billion, demonstrating robust market interest despite broader cryptocurrency volatility. However, investors must navigate several critical factors, including a $100 million token unlock scheduled for August 5, which represents 2.7% of its total supply entering circulation.

Understanding these market dynamics is crucial for making informed investment decisions regarding ENA tokens. The protocol’s innovative synthetic dollar mechanism, combined with its yield-generating capabilities through sUSDe staking, positions Ethena uniquely within the DeFi ecosystem. This analysis provides investors with the essential insights needed to evaluate ENA’s investment potential amidst current market conditions.

Current Market Dynamics August 2025 Ethena ENA Investment Analysis

Token Unlock Impact Assessment

The cryptocurrency community closely monitors the August 5th token unlock event, which introduces approximately 250 million ENA tokens into circulation. Historically, unlocks of this scale tend to produce increased volatility or temporary downside, especially when preceded by inflows, making this a critical period for ENA investors.

Despite concerns about selling pressure, Ethena price held firm at key support levels near $0.59 and reversed higher, suggesting strong underlying demand and investor confidence in the protocol’s fundamentals. This resilience indicates that the market may have already priced in much of the anticipated unlock impact.

The token unlock represents a natural part of Ethena’s tokenomics structure, designed to gradually distribute tokens to early supporters, team members, and investors. While such events typically create short-term selling pressure, they also contribute to healthier long-term token distribution and reduced concentration risk.

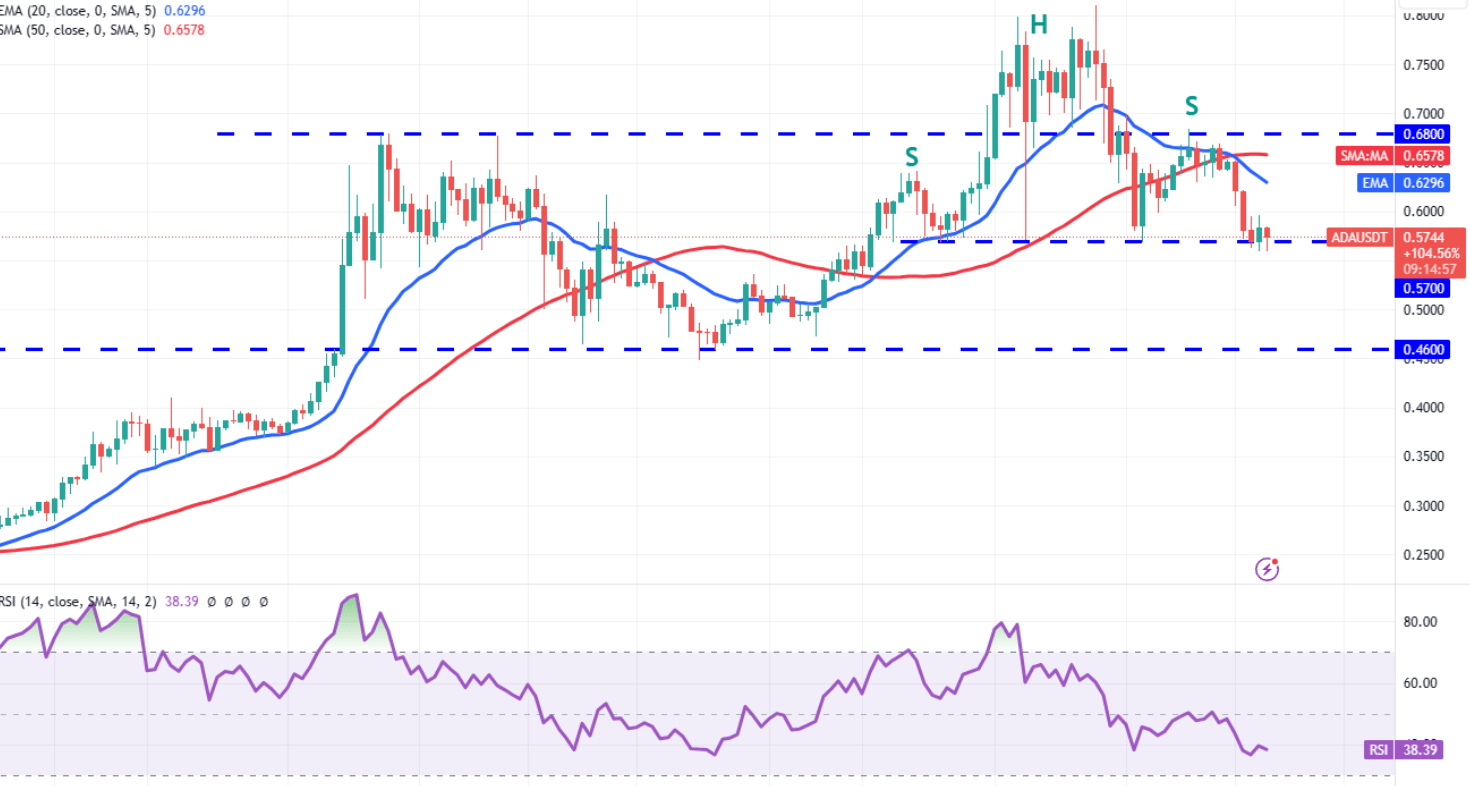

Technical Analysis and Price Patterns

Current technical indicators reveal mixed signals for ENA’s near-term trajectory. Price consolidates between $0.580–$0.620 with bullish bias toward breakout, suggesting potential for upward movement if key resistance levels are breached.

However, technical analysts note concerning divergences in momentum indicators. Rising volume contrasts weakening MACD, hinting at a possible near-term correction, which investors should monitor closely when making position timing decisions.

The current trading range provides clear reference points for risk management strategies. The $0.580 level serves as crucial support, while a decisive break above $0.620 could signal the beginning of a more sustained upward trend.

Market Sentiment and Trading Volume

Trading activity has intensified significantly, with daily volumes consistently exceeding previous averages. This increased activity reflects heightened institutional and retail interest in ENA, driven by both the token unlock event and broader recognition of Ethena’s protocol innovation.

Market sentiment remains cautiously optimistic despite short-term uncertainties. The protocol’s ability to maintain stability during volatile market conditions demonstrates its resilience and the effectiveness of its delta-hedging mechanisms.

Protocol Fundamentals Driving ENA Investment Value

USDe Synthetic Dollar Innovation

Ethena’s core value proposition centers on its revolutionary approach to creating synthetic dollars. Ethena’s synthetic dollar, USDe, provides the crypto-native, scalable solution for money achieved by delta-hedging Bitcoin and other crypto assets through sophisticated derivatives strategies.

This mechanism eliminates traditional stablecoin limitations by removing dependency on fiat banking systems while maintaining dollar stability. The protocol’s ability to generate yield through funding rate arbitrage and staking rewards creates ongoing value for ecosystem participants.

The synthetic approach allows unlimited scalability without requiring equivalent fiat reserves, positioning USDe advantageously against traditional stablecoins like USDC or USDT that face regulatory and banking infrastructure constraints.

sUSDe Staking Mechanism and Yield Generation

The staked version of USDe, known as sUSDe, represents one of the protocol’s most compelling features for investors. When you stake your USDe into the Ethena protocol, you receive sUSDe, which automatically starts earning yield through protocol revenue sharing.

Currently, the live Ethena Staked USDe price today is USD 1.19, reflecting accumulated rewards since the protocol’s launch. At launch, the value will be 1 sUSDe = 1 USDe, but sUSDe is expected to slowly increase in value as protocol-level rewards are transferred into the Staking smart contract.

The staking mechanism provides several advantages for users:

Automatic Compounding: Unlike staking platforms that pay you in new tokens or “rewards,” sUSDe compounds value directly into the token itself.

Liquidity Maintenance: The token remains pegged to the U.S. dollar and is redeemable at any time back to USDe at a 1:1 ratio.

Risk Protection: Users can only receive positive or flat rewards while staking USDe; periods of negative protocol revenue are not passed on to sUSDe.

Revenue Generation and Sustainability

Ethena’s revenue model demonstrates strong fundamentals for long-term sustainability. The staking rewards primarily come from fees generated by the Ethena protocol, such as minting and redeeming fees, along with profits from delta-hedging activities.

The protocol generates revenue through multiple streams, including funding rate arbitrage, staking rewards from underlying assets, and transaction fees. This diversified approach reduces dependency on any single revenue source and provides stability during varying market conditions.

Investment Strategy Framework for ENA Tokens

Short-Term Trading Considerations

For traders focused on short-term opportunities, the current market environment presents both risks and rewards. The token unlock event creates potential volatility that skilled traders might exploit, but requires careful risk management. Key levels to monitor include the established support at $0.580 and resistance near $0.620.

A breakdown below support could trigger additional selling pressure, while a breakout above resistance might indicate renewed bullish momentum. Volume analysis remains crucial for validating price movements. Sustained high volume accompanying any directional move increases the probability of continuation, while low-volume moves often prove temporary.

Long-Term Investment Thesis

Long-term investors should focus on Ethena’s protocol fundamentals rather than short-term price fluctuations. The synthetic dollar approach addresses real limitations in the current stablecoin landscape and provides sustainable competitive advantages. The protocol’s ability to generate yield through multiple mechanisms creates ongoing value for token holders and ecosystem participants.

As adoption of USDe expands across DeFi protocols, demand for the underlying infrastructure should increase correspondingly. Regulatory clarity in the synthetic asset space could serve as a significant catalyst for broader adoption. Ethena’s transparent, on-chain operations position it favorably for compliance with evolving regulatory frameworks.

Risk-Adjusted Position Sizing

Appropriate position sizing remains crucial for ENA investments given the protocol’s innovative but relatively nascent technology. Conservative investors might limit ENA exposure to 3-5% of their crypto portfolio, while more aggressive investors with deep protocol understanding might consider higher allocations.

Dollar-cost averaging strategies can help mitigate timing risk, particularly given current volatility around the token unlock event. Regular purchases over several months can smooth out short-term price fluctuations and build positions at favorable average costs.

Competitive Landscape and Market Positioning

Advantages Over Traditional Stablecoins

Ethena’s synthetic approach offers several key advantages over centralized stablecoins. The protocol eliminates counterparty risk associated with fiat reserves while providing yield generation capabilities that traditional stablecoins cannot match. The delta-hedging mechanism provides stability without requiring one-to-one fiat backing, enabling unlimited scalability as demand for USDe grows.

This scalability advantage becomes increasingly important as the DeFi ecosystem expands. Censorship resistance represents another significant advantage. Unlike USDC or USDT, which can be frozen at the contract level, USDe maintains the decentralized properties that make cryptocurrencies attractive to global users.

Comparison with Decentralized Stablecoins

Compared to other decentralized stablecoins like DAI, Ethena offers superior capital efficiency and yield generation. The protocol’s active hedging strategy generates positive returns rather than merely maintaining stability through over-collateralization. The synthetic approach also provides better scalability than collateral-dependent stablecoins, which face limitations based on available collateral and liquidation risks during extreme market conditions.

Market Share Growth Potential

The global stablecoin market continues expanding rapidly, with total market capitalization approaching $200 billion. Ethena’s unique value proposition positions it to capture significant market share, particularly among DeFi-native users seeking yield-bearing dollar alternatives.

Institutional adoption of synthetic dollars could dramatically accelerate growth. As traditional financial institutions explore DeFi integration, protocols like Ethena that combine stability with yield generation become increasingly attractive.

Price Prediction Analysis and Market Outlook

Near-Term Price Projections

Various analytical models provide different perspectives on ENA’s price trajectory through the remainder of 2025. According to our Ethena forecast, the price of Ethena will decrease by -24.78% over the next month and reach $0.415622 by September 2, 2025, suggesting potential volatility following the token unlock.

However, other models present more optimistic outlooks. By 2025, Ethena could stabilize around a minimum of $0.6680090, with the upper limit reaching an impressive $0.9192965, indicating significant upside potential if protocol adoption accelerates. The divergence in predictions reflects the inherent uncertainty in cryptocurrency markets and the innovative nature of Ethena’s protocol. Investors should consider multiple scenarios when making investment decisions.

Medium-Term Growth Catalysts

Several factors could drive ENA price appreciation over the next 12-18 months. Increased USDe adoption across major DeFi protocols would demonstrate real-world utility and validate the synthetic dollar approach. Regulatory clarity around synthetic assets could remove the uncertainty that currently limits institutional participation.

Clear guidelines would enable traditional financial institutions to integrate synthetic dollars into their operations. Protocol upgrades and feature additions, such as cross-chain expansion or additional yield-generating mechanisms, could attract new users and increase the overall value of the ecosystem.

Long-Term Investment Outlook

The long-term investment case for ENA rests on the fundamental thesis that synthetic assets represent the future of decentralized finance. If this thesis proves correct, early adopters of innovative protocols like Ethena could benefit significantly.

Market maturation should reduce volatility over time while increasing overall adoption. As the ecosystem grows and stabilizes, ENA tokens may transition from speculative investments to yield-bearing assets within diversified DeFi portfolios.

Risk Management and Due Diligence

Protocol-Specific Risk Assessment

Investors must carefully evaluate risks unique to Ethena’s synthetic dollar mechanism. The complexity of delta-hedging requires sophisticated risk management and could face challenges during extreme market volatility or liquidity crises.

Smart contract risk remains present despite thorough auditing. The protocol’s innovative nature means less battle-testing compared to more established DeFi protocols, potentially increasing the risk of undiscovered vulnerabilities.

Counterparty risk from derivatives exchanges used for hedging represents another consideration. While Ethena diversifies across multiple venues, concentrated exposure to any single exchange could impact protocol operations.

Market and Liquidity Risks

ENA token liquidity, while currently strong, could deteriorate during market stress conditions. The token unlock event provides a stress test for market liquidity and price stability under increased supply pressure. Correlation with broader cryptocurrency markets limits diversification benefits. During systematic market downturns, ENA may decline alongside other crypto assets regardless of protocol-specific performance.

Regulatory and Compliance Considerations

The synthetic nature of USDe may attract regulatory scrutiny as authorities develop frameworks for digital assets. Changes in regulatory treatment could significantly impact protocol operations and token value. Geographic restrictions on protocol access could limit growth potential in certain markets. Compliance requirements may increase operational complexity and costs over time.

Advanced Investment Strategies and Tactics

Yield Farming and DeFi Integration

Sophisticated investors can enhance returns through strategic use of USDe and sUSDe across various DeFi protocols. The stable nature of USDe makes it suitable for liquidity provision, while sUSDe’s yield generation provides additional return streams.

Cross-protocol strategies might involve using USDe as collateral for borrowing while simultaneously earning yields through sUSDe staking. However, such strategies increase complexity and risk, requiring careful monitoring and management.

Options and Derivatives Strategies

For investors comfortable with derivatives, options strategies can provide downside protection or enhanced returns. Covered call writing against ENA positions could generate additional income during sideways price action. Put options might serve as insurance against significant downside risk, particularly valuable during periods of high uncertainty like token unlock events.

Portfolio Hedging Techniques

ENA’s correlation with broader crypto markets suggests potential hedging benefits during portfolio construction. The protocol’s stability mechanisms might provide some insulation during extreme market volatility. However, investors should not rely solely on ENA for hedging purposes. Proper portfolio diversification requires assets with varying correlation profiles and risk characteristics.

Institutional Investment Perspective

Corporate Treasury Applications

The stability and yield characteristics of USDe make it attractive for corporate treasuries seeking alternatives to traditional cash management. Companies with crypto operations could benefit from dollar-denominated assets that generate yield while maintaining stability. The protocol’s transparency and on-chain verifiability address compliance requirements that corporate treasuries face when managing digital assets.

Institutional DeFi Integration

As traditional financial institutions explore DeFi integration, synthetic dollars like USDe provide familiar dollar exposure with enhanced functionality. The ability to generate yield while maintaining stability appeals to institutional risk management frameworks.

Institutional adoption could provide significant growth catalysts for both USDe usage and ENA token value. Large-scale adoption would validate the synthetic dollar approach and potentially drive substantial price appreciation.

Environmental and Sustainability Considerations

Energy Efficiency Advantages

Ethena’s Ethereum-based architecture benefits from the network’s transition to Proof-of-Stake consensus, significantly reducing energy consumption compared to Bitcoin-based alternatives. This alignment with environmental sustainability goals may attract ESG-focused investors. The protocol’s efficiency in maintaining dollar stability without requiring extensive mining or energy-intensive consensus mechanisms positions it favorably for environmentally conscious investment strategies.

Long-Term Sustainability Framework

The protocol’s revenue generation mechanisms create sustainable funding for ongoing development and maintenance without relying on token inflation or unsustainable yield farming programs. This approach supports long-term protocol health and investor confidence.

Also Read: Ethereum’s Role in Solving AI’s Black Box Problem

Conclusion

This comprehensive Ethena ENA investment analysis reveals a protocol navigating significant market dynamics while maintaining strong fundamental value propositions. The August 2025 token unlock event presents both challenges and opportunities, with the protocol demonstrating resilience in maintaining key support levels despite supply pressure concerns.

The investment case for ENA extends beyond short-term price movements to encompass the broader potential of synthetic dollar adoption in DeFi. Ethena’s innovative delta-hedging mechanism, combined with sUSDe’s yield generation capabilities, positions the protocol uniquely within the evolving stablecoin landscape.

For investors considering ENA exposure, success requires balancing the protocol’s significant innovation potential against inherent risks, including smart contract complexity, market volatility, and regulatory uncertainty. The token unlock event provides a near-term stress test, while long-term value depends on continued protocol adoption and successful execution of the synthetic dollar thesis.