Common Crypto Metrics: An Ultimate Guide By Esteemcrypto

Market Capitalization

Market capitalization (or market cap) gauges the relative size of a cryptocurrency. To calculate it, you have to use the following formula:

“multiply the current price of a cryptocurrency by the total number of coins in circulation.”

For example, if a cryptocurrency is priced at $10,000 per unit and there are 20 million coins in circulation, the market capitalization for that cryptocurrency would be $200 billion. This metric is important because it gives you a sense of the size of the cryptocurrency market. It can help you determine whether a particular cryptocurrency is overvalued or undervalued.

Funding Rates

Funding rates are recurring payments between traders to maintain a perpetual futures contract’s price around the index price. A perpetual futures contract is an agreement to purchase or sell an item without a defined expiration date. The trader may hold positions for as long as they choose, but to do so, holding fees—also referred to as the funding rate—must be paid.

Funding rates in the perpetual swaps market reflect traders’ sentiments and are inversely correlated with the amount of contracts. Favorable financing rates indicate that long-term investors are in control and are prepared to provide cash to short-term investors. Negative financing rates imply that short-term traders are in control and prepared to compensate for their losses relative to long-term traders.

Open Interest

The quantity of contracts transacted in the market at any particular moment is known as open interest. It’s an additional method to assess interest in the cryptocurrency space. Open interest is one of the most popular volume-based indicators since it shows how many open positions market participants have at any moment—long and short.

The total number of open trade positions is added, and the total number of closed deals is subtracted to arrive at the calculation. This statistic is significant because it provides a broad picture of market capital inflows. The amount of open interest increases when more money is received, and vice versa.

Stablecoin Flows

A measure that depicts the general pattern of stablecoin volume and activity is called a “stablecoin flow.” This data analysis may provide a more comprehensive picture of investor opinion toward stablecoin. Suppose there is a sell-off in the market, and investors believe their cryptocurrency investment will lose value. Then, users can find stability in stablecoins while still having the freedom to re-enter the market quickly.

Exchange Flows

A metric called exchange flows measures the flow of cryptocurrencies into and out of an exchange. It examines the quantity of coins added to or removed from exchange wallets.

Fear & Greed Index

The Fear & Greed Index is an all-encompassing cryptocurrency indicator that gauges investors’ feelings. The software company Alternative. I developed the index for Bitcoin BTC $64,305 and other well-known cryptocurrencies. The index measures the overall sentiment of the bitcoin market by calculating a score between 0 (extreme fear) and 100 (extreme greed) using weighted data sources.

Every day at midnight Greenwich Mean Time, the Fear and Greed Index, and other cryptocurrency asset indices track market sentiment to provide insight into the market’s mood and emotions. Like previous indexes for different crypto assets, the Bitcoin Fear and Greed Index is predicated on the notion that Bitcoin investors are generally erratic and emotional.

Network Value to Transactions Ratio (NVT)

The NVT ratio describes the link between market capitalization and transfer volume. A particular perspective on NVT is that it compares two of Bitcoin’s main value propositions:

-

Market Cap: Store of Value

-

Transfer Volume: Settlement/Payments Network

Realized Capitalization

A market capitalization known as realized capitalization, or realized cap, gives a value to each unspent transaction output. The value at which it was last transferred is the foundation rather than its current value. Consequently, instead of representing the market value, it means the realized worth of every coin in the network.

The realized cap, which weights coins based on their actual presence in a chain’s economy, lessens the impact of lost and long-dormant currencies. The realized cap is increased by the same amount when a coin previously transferred at a lower price is spent since the coins are now valued at the current price.

Bitcoin Heat Map

The premise behind the Bitcoin heat map is that the 200-week moving average has historically marked the cycle bottom for the price of Bitcoin. With the help of historical price data, this cryptocurrency indicator generates a color heat map that shows the percentage of gains over the 200-week moving average (MA).

Extended The monthly color variations on the Bitcoin heat map allow investors to identify patterns. For instance, the price chart’s orange and red dots indicate that the cryptocurrency is overbought relative to its price over the preceding 200 weeks. They have historically marked the best periods to sell Bitcoin. On the other hand, buying Bitcoin is typically recommended when the price dots are purple and around the 200-week MA.

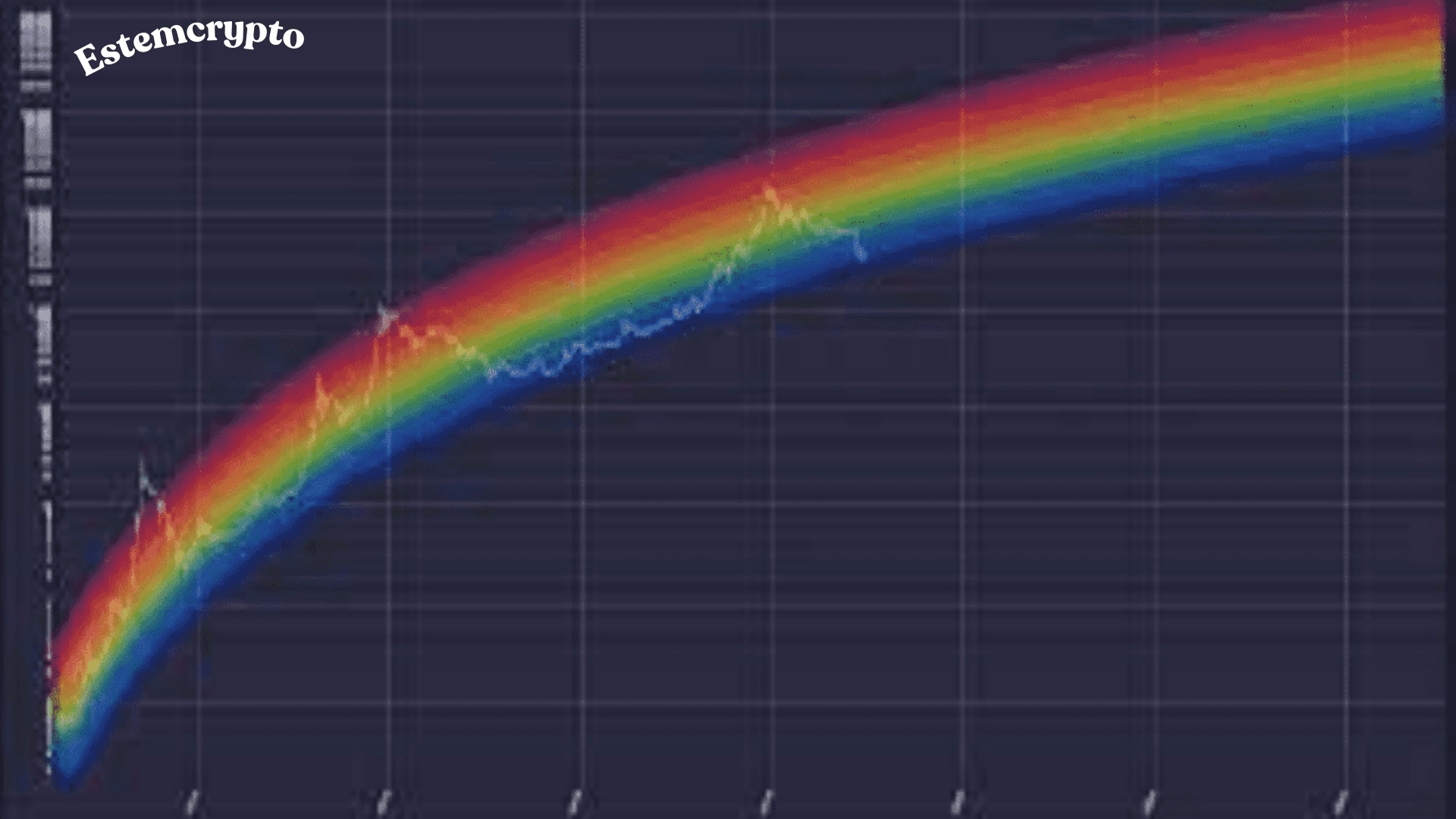

Bitcoin Rainbow Chart

The eight rainbow-colored bands that categorize Bitcoin price ranges into groups like “Fire Sale,” “Accumulate,” and “HODL” are what give rise to the name “Strangerland Chart.” Based on trends seen across prior cycles, the Rainbow Chart approach enables investors to identify patterns indicating when Bitcoin is at its most advantageous position.

Remember that the eight bands do not buy and sell signals when reviewing this vast data history. Due to market volatility and other factors, past performance is not a reliable predictor of future results, particularly in cryptocurrency.

On-balance Volume (OBV)

A technical indicator on-balance volume (OBV) gauges a cryptocurrency’s momentum. It is a method for forecasting asset price changes by calculating the volume change component. The compounding indicator OBV measures the urge to buy and sell by increasing volume on up days and decreasing it on down days.

Under the OBV principle, an asset’s 24-hour volume is “up-volume” when its price closes higher than the previous day. A price closure less than its last close is called “down-volume.” A positive OBV reading indicates More pressure to buy, while a negative OBV reading indicates more pressure to sell.

Accumulation/Distribution Line

The accumulation/distribution line shows the link between an asset’s price and the percentage of buyers and sellers in a given market. By identifying any difference between the price and the indication, the illustration enables traders to determine whether the market is bullish or bearish. A sharp decline in an asset’s value followed by an increase could indicate that demand is about to increase. This suggests buyers are becoming more powerful, and sellers are losing control.

Average Directional Index (ADX)

A technical indicator called the average directional index (ADX) gauges the strength of a trend. Two other indicators show that the trend may be either up or down: the positive directional indicator (+DI), which indicates the presence of an uptrend, and the negative directional indicator (-DI), which suggests the presence of a downtrend. For this reason, the ADX often consists of three distinct lines. These determine whether a transaction should be long or short, or made at all.

Aroon Indicator

Technical indicators like the Aroon indicator can be used to identify shifts in the price trend and its strength. Strong downtrends are seen to routinely see new lows, whereas strong uptrends are thought to see new highs frequently. The Aroon up and down lines travel between zero and one hundred. Strong trends are indicated by values close to one hundred, and weak trends are indicated by values close to zero.

Moving Average Convergence-divergence Indicator (MACD)

The moving average convergence divergence, or MACD, displays the relationship between two moving averages of the price of an asset. Generally speaking, the MACD helps investors assess whether the bullish or bearish trend in a price is intensifying or decreasing.

The difference between the 12-period and 26-period exponential moving averages (EMAs) is used to compute it. EMA for nine days is called the “signal line,” it serves as a trigger for buy and sell signals. Once the MACD crosses the signal line, traders can buy the asset. Traders have the option to sell or short the asset if it crosses below the signal line.

Relative Strength Index (RSI)

A technical analysis indicator called the RSI assesses whether a stock or other asset is overbought or oversold by analyzing the magnitude of recent price swings. RSI is represented as an oscillator with a range of 0 to 100.

According to conventional interpretation and usage, an RSI value of 70 or higher indicates that a security is overbought or overvalued. Therefore, a trend reversal or corrective price retreat could be imminent. On the other hand, an RSI reading of 30 or lower indicates that the security may be overpriced or oversold.

Stochastic Oscillator

A stochastic oscillator compares a security’s closing price to a range of prices over a specified period. The oscillator’s market sensitivity can be reduced by changing the time frame or generating a moving average. Overbought and oversold trading signals are produced within a specified range of values from zero to one hundred.

Because it is range-bound, the stochastic oscillator oscillates constantly between zero and one hundred. Therefore, it can indicate whether the market is overbought or oversold. Traditionally, readings under 20 are considered oversold, and values over 80 are overbought.

The Puell Multiple Crypto Indicator

The Puell Multiple is a measure used to compare the earnings of Bitcoin miners to the price of Bitcoin. This measure roughly represents the amount of sell pressure created when miners sell Bitcoin rewards to cover fixed costs like power and mining gear.

Traders commonly use the Puell Multiple to gauge the state of miner revenues. For example, a low Puell Multiple may indicate low sale pressure, and a high Puell Multiple may indicate significant sell pressure. Miners frequently have access to substantial sums of Bitcoin reserved for institutional miners. Therefore, comprehending their pressure to sell can help identify short-term price trends before the markets notice them.

The Stock-to-flow (S2F) Crypto Model

A popular indicator that displays the ratio of an asset’s current stock to its fresh production flow is the S2F model. This ratio is typically expressed as the number of years needed to double supply at the current production rate or as a yearly growth in supply expressed as a percentage.

The tenet of scarcity as the source of value is the foundation of the S2F concept. For instance, in the case of Bitcoin, the quantity in circulation is known as the current stock, while newly created Bitcoin is referred to as the flow of fresh production. The estimated S2F ratio shows how long it would take to manufacture twice as much Bitcoin at the current output rate.