Bitcoin Price Volatility Continues at Critical Levels

Bitcoin Price Volatility Continues: Bitcoin (BTC), the pioneer of cryptocurrencies, has always been known for its volatile nature. Since its inception in 2009, the digital currency has experienced dramatic price swings that have made headlines worldwide. As of now, Bitcoin’s price volatility continues at critical levels, sparking discussions and debates among investors, analysts, and enthusiasts. In this article, we will explore the reasons behind Bitcoin’s ongoing price volatility, its implications for the market, and what the future might hold for this digital asset Bitcoin on the Rise: How Fed Policies.

Understanding Bitcoin’s Volatility

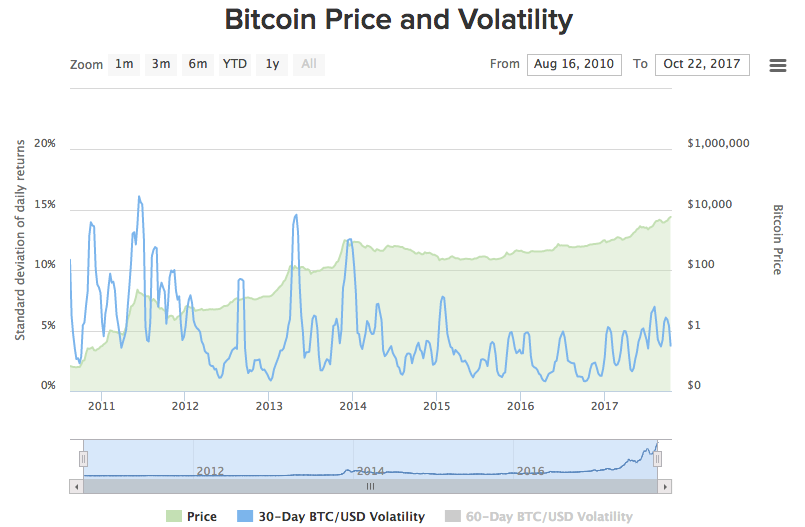

Bitcoin’s price volatility is not a new phenomenon. It has been an inherent characteristic of the cryptocurrency since its early days. Several factors contribute to this volatility, including market sentiment, regulatory developments, macroeconomic trends, and technological advancements. To understand why Bitcoin’s price remains highly volatile, let’s delve into some of these factors in detail.

Market Sentiment and Speculation

One of the primary drivers of Bitcoin’s price volatility is market sentiment and speculative trading. Unlike traditional assets, Bitcoin’s value is not tied to any physical asset or national economy. Instead, its price is largely influenced by supply and demand dynamics, investor sentiment, and speculation.

When positive news or developments surrounding Bitcoin emerge, such as institutional adoption, regulatory clarity, or technological upgrades, it can trigger a surge in demand and drive prices higher. Conversely, negative news, such as security breaches, regulatory crackdowns, or macroeconomic uncertainties, can lead to panic selling and significant price drops. The speculative nature of Bitcoin trading amplifies these price movements, contributing to its overall volatility.

Regulatory Developments

Regulatory developments play a crucial role in shaping Bitcoin’s price volatility. Cryptocurrencies operate in a relatively nascent and evolving regulatory landscape, with different countries adopting varying approaches to their regulation. Any announcement or action by governments and regulatory bodies can have a profound impact on Bitcoin’s price.

For instance, positive regulatory developments, such as the recognition of Bitcoin as a legal form of payment or the approval of Bitcoin exchange-traded funds (ETFs), can boost investor confidence and drive prices higher. On the other hand, stringent regulations, bans on cryptocurrency trading, or negative statements from influential regulators can trigger panic selling and cause sharp price declines. The uncertainty surrounding regulatory actions keeps Bitcoin’s price highly volatile.

Macroeconomic Trends

Bitcoin’s price is also influenced by macroeconomic trends and global financial markets. As a decentralized and borderless digital currency, Bitcoin is often seen as a hedge against traditional financial systems and macroeconomic instability. During times of economic uncertainty or geopolitical tensions, investors may turn to Bitcoin as a store of value and a safe haven asset.

For example, in 2020, when the COVID-19 pandemic disrupted global economies, Bitcoin experienced a significant price rally. Investors sought refuge in Bitcoin amid fears of inflation, currency devaluation, and the overall uncertainty surrounding traditional financial markets. Similarly, geopolitical events, such as trade wars, political unrest, or economic sanctions, can impact Bitcoin’s price as investors look for alternative assets to diversify their portfolios.

Technological Advancements and Upgrades

Technological advancements and upgrades within the Bitcoin network can also contribute to its price volatility. Bitcoin’s underlying blockchain technology is constantly evolving, with developers working on improvements to enhance its scalability, security, and functionality. Significant upgrades or hard forks can create uncertainty and impact Bitcoin’s price.

For instance, the anticipation of a major protocol upgrade or the implementation of new features, such as the Lightning Network for faster transactions or Taproot for enhanced privacy, can generate excitement and drive prices higher. However, the uncertainty and potential risks associated with these upgrades can also lead to increased volatility as investors react to the unknown outcomes.

Implications of Bitcoin’s Volatility

Bitcoin’s price volatility has several implications for different stakeholders within the cryptocurrency ecosystem, including investors, businesses, regulators, and the broader financial market. Let’s explore some of these implications in more detail.

Investor Sentiment and Trading Strategies

Bitcoin’s price volatility presents both opportunities and challenges for investors. On one hand, the potential for significant price swings creates opportunities for traders to profit from short-term price movements. Many traders employ strategies such as day trading, swing trading, or arbitrage to capitalize on Bitcoin’s volatility.

However, the high volatility also poses risks, especially for inexperienced or risk-averse investors. The potential for sudden and substantial price drops can lead to significant losses. It is important for investors to conduct thorough research, manage risk, and adopt appropriate trading strategies when dealing with Bitcoin’s volatile nature.

Adoption and Mainstream Acceptance

Bitcoin’s volatility can impact its adoption and mainstream acceptance as a medium of exchange and a store of value. While Bitcoin has gained recognition and adoption among institutional investors, businesses, and even some governments, its price volatility remains a barrier to wider acceptance.

For businesses, accepting Bitcoin as a payment method can be challenging due to the potential for sudden price fluctuations. Merchants may face difficulties in pricing their goods and services accurately and may incur losses if Bitcoin’s value drops significantly after a transaction. To mitigate this risk, some businesses use payment processors that instantly convert Bitcoin payments into fiat currency.

On the other hand, Bitcoin’s price volatility can also attract investors seeking high returns and diversification. Institutional investors, such as hedge funds, asset managers, and family offices, have started to allocate a portion of their portfolios to Bitcoin as a speculative investment or a hedge against traditional assets. The increasing institutional interest in Bitcoin has contributed to its growing legitimacy and acceptance within the broader financial market.

Regulatory Considerations

Bitcoin’s price volatility also poses challenges for regulators and policymakers. The highly volatile nature of Bitcoin makes it difficult to establish consistent regulatory frameworks and protect investors from potential risks. Regulators must strike a balance between fostering innovation and ensuring consumer protection.

In response to Bitcoin’s volatility, some countries have implemented regulations to address issues such as market manipulation, fraud, and money laundering. These regulations aim to enhance transparency, investor protection, and market integrity within the cryptocurrency ecosystem. However, the evolving nature of the market and the global nature of cryptocurrencies make regulatory coordination a complex task.

Future Outlook for Bitcoin

Despite its price volatility, Bitcoin continues to attract significant attention and interest from investors, businesses, and the general public. The future outlook for Bitcoin remains uncertain, with several factors likely to influence its price dynamics in the coming years.

One of the key factors that will impact Bitcoin’s future volatility is regulatory developments. As governments and regulatory bodies gain more experience and understanding of cryptocurrencies, they are likely to implement more comprehensive and consistent regulatory frameworks. Clearer regulations can provide greater certainty and stability, potentially reducing Bitcoin’s price volatility.

Technological advancements within the Bitcoin network and the broader cryptocurrency ecosystem will also play a crucial role in shaping its future. Innovations that enhance scalability, security, and user experience can increase Bitcoin’s utility and adoption, potentially reducing its volatility over time.

Furthermore, the growing institutional interest in Bitcoin and the increasing integration of cryptocurrencies into traditional financial systems can contribute to its long-term stability. As more institutional investors enter the market and establish robust infrastructure for trading and custody, Bitcoin’s price volatility may decrease, making it a more attractive asset for a wider range of investors.

Conclusion

Bitcoin’s price volatility continues to captivate the attention of investors, analysts, and enthusiasts worldwide. Understanding the factors driving this volatility, as well as its implications, is essential for navigating the cryptocurrency market. While Bitcoin’s price swings present opportunities for traders, they also pose risks for inexperienced investors and challenges for mainstream adoption. As the cryptocurrency market evolves and regulatory frameworks mature, Bitcoin’s volatility may gradually stabilize, paving the way for its continued growth and acceptance in the global financial landscape.

[sp_easyaccordion id=”4293″]