Bitcoin Approaches $100K Amid Rising Institutional Interest

Sitting just at $95,000, Bitcoin nears $100K is nearing a pivotal point as of April 29, 2025. Investors and analysts have once more drawn attention to this increase in value since many believe Bitcoin nears $100K will soon reach the sought-after $100,000 level. Growing institutional interest and changes in the economy mostly inspire this hope. Though Bitcoin nears $100K performance is still excellent, altcoins are displaying different results, which results in a mixed environment throughout the Cryptocurrency Market.

Bitcoin’s Surge in Demand

There are various reasons why Bitcoin’s value has skyrocketed so remarkably. Rising global economic uncertainty is driving growing mistrust of conventional investment assets, including U.S. Treasuries. Searching for alternatives, investors find Bitcoin to be increasingly appealing. With its fixed supply and distributed character, which make it a consistent store of value, the digital asset is today considered a possible hedge against inflation and geopolitical concerns.

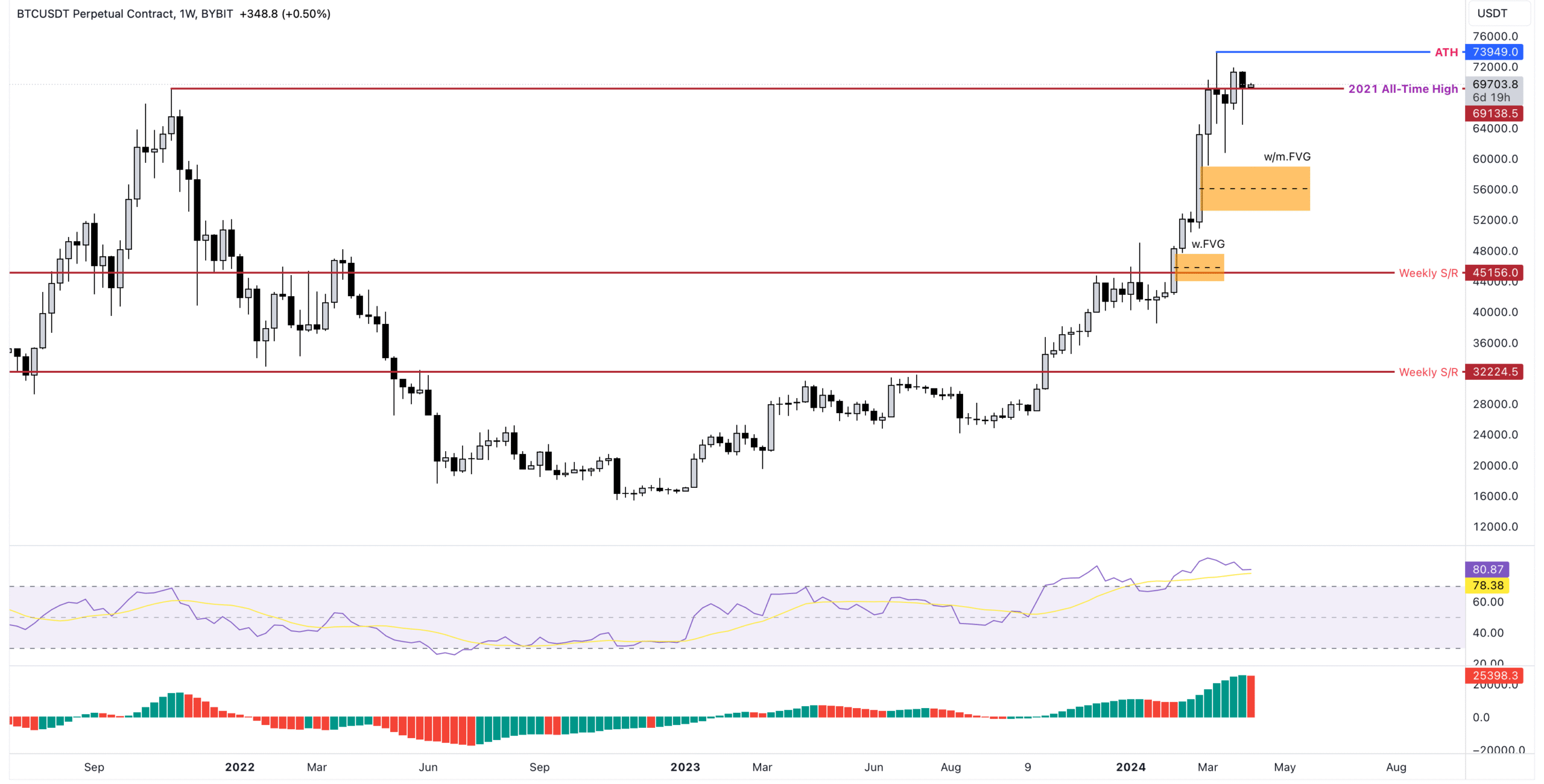

This favorable attitude is reinforced by the rising conviction that Bitcoin may surpass the $100,000 mark. Although it is only slightly below that amount right now, experts believe it might rise considerably more, maybe reaching $120,000 in the near future. An increase in investor confidence—especially in the United States—drives this possible surge. Particularly with investors moving their money into assets like Bitcoin, which has beaten conventional tech stocks since its low point of $76,000 in early April, President Trump’s deferral of tariffs has spurred fresh hope.

Institutional demand also supports the price rise of Bitcoin. As more and more big investors—including pension funds and sovereign wealth funds—move into Bitcoin, forthcoming SEC filings should highlight even more notable ownership. Considered as a positive indication that Bitcoin is becoming more and more accepted as a legitimate asset class is this institutional interest. Furthermore supporting the ongoing expansion of the digital currency are legislative developments on possible stablecoins.

Altcoin Market Volatility

The altcoin market stays significantly more erratic even if Bitcoin’s positive trend continues. The second-largest cryptocurrency by market capitalization, Ethereum (ETH), has seen a minor dip. ETH, trading at about $1,805, has dropped by about 0.6% during the past 24 hours. Ethereum’s price performance has lagged behind Bitcoin’s recent increase even if it plays a significant part in the distributed finance (DeFi) ecosystem and has seen growth.

Other well-known cryptocurrencies, such as XRP and Solana (SOL), have likewise experienced more subdued price swings. Though it is not seeing much expansion right now, Solana—known for its quick transaction speeds and scalability—has drawn interest in the crypto scene. Comparably, XRP, which has been entangled in legal disputes with the U.S. Securities and Exchange Commission (SEC), is trading at $2.25, down 1.3% in the past 24 hours. Especially in contrast to Bitcoin’s unambiguous rising trajectory, these contradictory signals from top altcoins imply that the altcoin market is still erratic and volatile.

Not all altcoins, meanwhile, are having difficulties. With an evident increase in trade volume, Cardano (ADA) has shown promise recently. ADA, which is currently valued at $0.70, shows indications of optimistic activity, which has some experts projecting a possible price climb. Long term, Cardano’s prospects are bright; some analysts predict a price increase comparable to its 2021 highs, maybe bringing the price to $6 in the following months. Growing curiosity in Cardano’s Proof-of-Stake (PoS) blockchain system could help to sustain the rising trend.

Altcoin Institutional Interest

Fascinatingly, institutional interest spans more than just Bitcoin. Starting on May 19, 2025, the Chicago Mercantile Exchange (CME) has announced intentions to introduce cash-settled futures contracts for XRP pending regulatory clearance. For the larger bitcoin ecosystem, this action shows that institutional interest in altcoins is also rising. Solana futures contracts introduced by the CME emphasize even more the tendency of conventional financial institutions to extend their products into the cryptocurrency domain.

As more people search to diversify their crypto portfolios outside of Bitcoin and Ethereum, this institutional curiosity in altcoins could indicate a possible change in the market. Should altcoins like XRP and Solana keep becoming popular among institutional investors, their values may rise really soon.

Crypto Market Outlook

The cryptocurrency market as a whole is currently in a state of cautious optimism. Bitcoin’s continued rise is encouraging, and the potential for it to reach the $100,000 mark is within reach. However, the mixed performance of altcoins suggests that there are still significant risks and challenges within the broader market. While some altcoins, like Cardano and Solana, show potential for growth, others are facing headwinds, making it crucial for investors to proceed with caution.

For investors, this means conducting thorough research and staying informed about the ever-changing market dynamics. The key to success in the cryptocurrency space is understanding the risks involved and maintaining a diversified portfolio. With Bitcoin’s bullish momentum and altcoins showing a mix of potential and volatility, the next few months could be a pivotal time for the market.

Final thoughts

Ultimately, institutional interest and increased investor confidence show in Bitcoin’s consistent ascent toward the $100,000 milestone. Bitcoin’s price is probably going to keep rising as its usage as a hedge against inflation and economic uncertainty increases. Altcoins, on the other hand, present a more mixed picture; some show promise while others find difficulty getting traction.

Although the future of Bitcoin seems obvious, the conflicting signals from altcoins emphasize the need for strategic investment and keeping current with market events. Investors have to carefully evaluate their risk tolerance and diversify their portfolios as usual to properly negotiate the continually changing bitcoin market.