Bank of America Begins Using Ripple Token for Internal Transactions

Bank of America Begins Using Ripple: In a groundbreaking move that signals a significant shift in the financial sector, Bank of America (BoA) has announced its adoption of Ripple’s digital token, XRP, for internal transactions. This decision marks one of the most notable instances of a major financial institution leveraging blockchain technology to streamline operations and enhance efficiency.

Why Ripple?

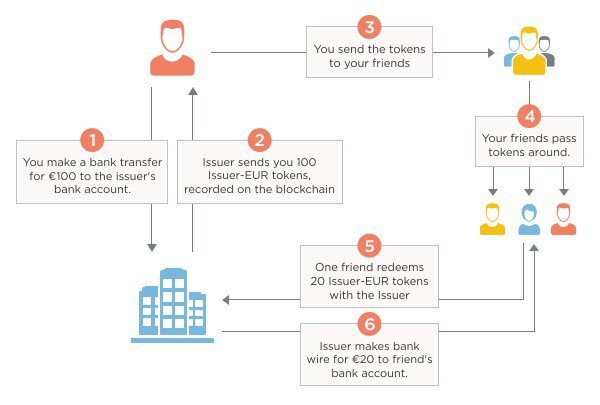

Ripple’s XRP has long been recognized for its speed and cost-effectiveness in cross-border payments. Unlike traditional banking systems that rely on multiple intermediaries and can take days to settle transactions, Ripple’s blockchain technology enables near-instant transfers with minimal fees. By adopting XRP for internal processes, Bank of America aims to reduce operational costs and improve transaction speeds within its vast network.

The Benefits of Bank of America

- Cost Efficiency: Traditional banking systems often incur high transaction fees due to the involvement of multiple intermediaries. Ripple’s technology eliminates these intermediaries, significantly reducing costs.

- Speed: Internal transactions that previously took hours or even days to settle can now be completed in seconds. This improvement allows BoA to allocate resources more effectively and improve customer service.

- Transparency and Security: Ripple’s blockchain provides a transparent ledger of all transactions, enhancing security and reducing the risk of fraud.

- Scalability: As one of the largest banks in the world, BoA requires a solution that can handle high transaction volumes. Ripple’s technology is designed to scale efficiently, making it a perfect fit for such a large institution.

What This Means for the Industry

Bank of America’s adoption of XRP is likely to have a ripple effect (pun intended) across the financial sector. It sets a precedent for other banks and financial institutions to explore blockchain solutions for their operations. This move also validates the potential of digital assets in mainstream finance, further bridging the gap between traditional banking and the cryptocurrency world.

Challenges Ahead

While the adoption of Ripple’s XRP is a bold step forward, it is not without challenges. Regulatory scrutiny remains a significant hurdle, particularly in the United States, where the legal status of digital assets is still evolving. Additionally, the integration of blockchain technology into existing banking systems requires significant investment and technical expertise.

Conclusion

Bank of America’s decision to utilize Ripple’s XRP for internal transactions represents a milestone in the evolution of the financial industry. By embracing blockchain technology, the bank is positioning itself as a leader in innovation and efficiency. As the adoption of digital assets continues to grow, this move could pave the way for a more interconnected and efficient global financial system. This development is not just a win for Ripple and its supporters but also a testament to the transformative potential of blockchain technology in reshaping traditional industries. The world will be watching closely as Bank of America embarks on this exciting journey.

[sp_easyaccordion id=”4158″]