Market Breadth Rises as Altcoins Join Bitcoin Rebound

In recent days, the digital‑asset landscape has begun to reflect improved market breadth as more than just Bitcoin participates in its rebound. For a long time, the crypto rally has been driven almost exclusively by Bitcoin, with altcoins trailing behind or largely stagnant. But now a new dynamic is emerging: the rally is broadening, and altcoins are joining the rebound alongside Bitcoin, indicating that the crypto market breadth improves and the recovery may be more durable and inclusive. In this article, we’ll explore what this shift means, examine the data and indicators behind it, look at the on‑chain and macro drivers, discuss how investors and traders should interpret the development, and assess whether this might be the early sign of a structural change in the ecosystem.

What Does “Market Breadth” Mean in Crypto and Why It Matters

When discussing the phrase “crypto market breadth improves”, it’s necessary to explain what market breadth is and why it’s important in the context of cryptocurrencies. Market breadth refers to how widely gains (or losses) are spread across the asset base rather than being concentrated in a small number of heavyweights. Historically, in the crypto space, rebounds often start with Bitcoin alone — yet for a sustainable rally, other digital assets must participate.

Breadth Versus Concentration

In a highly concentrated rally, Bitcoin might lead, and only a few altcoins follow. In such a scenario, market breadth is weak because the majority of assets remain unused or down. Weak breadth often signals vulnerability to reversal because the rally lacks broad support. Conversely, when a multitude of altcoins begin to participate—that is, when the altcoin market starts to move in tandem with Bitcoin—it suggests stronger underlying momentum. Indeed, analysts recently observed that “a growing number of large‑cap and mid‑cap altcoins are now participating in the recovery,” marking a shift in structure.

Indicators of Broadening Participation

There are several quantitative signals that market breadth is improving. For example, the proportion of top altcoins outperforming Bitcoin, the reduction in Bitcoin dominance (its share of the total market cap), rising trading volume and liquidity in alts, and on‑chain metrics such as exchange outflows for multiple assets. One newsletter noted that “tokens tied to major smart‑contract networks, scaling infrastructure, and DeFi platforms recorded gradual price gains across several sessions,” indicating a broader participation.

When the phrase “altcoins join Bitcoin rebound” is used, it captures the notion that the bounce is no longer an isolated Bitcoin affair but increasingly includes the wider ecosystem. For traders and investors, this development matters because it opens up more opportunities, reduces concentration risk, and perhaps points to a mature cycle.

Recent Evidence of Broader Recovery Across Altcoins

There is recent market evidence supporting the claim that the crypto market breadth improves as altcoins join the Bitcoin rebound. Let’s examine how the latest data backs this up.

Price Movements and Participation

According to recent market updates, Bitcoin rebounded from lows near $99,000 and traded above $106,000, while a growing number of altcoins joined that move. For example, major smart‑contract tokens and infrastructure coins showed incremental gains in line with the broader recovery. The article “Crypto Market Breadth Improves as Altcoins Join Bitcoin Rebound” noted that tokens tied to smart‑contract networks and DeFi climbed across several sessions.

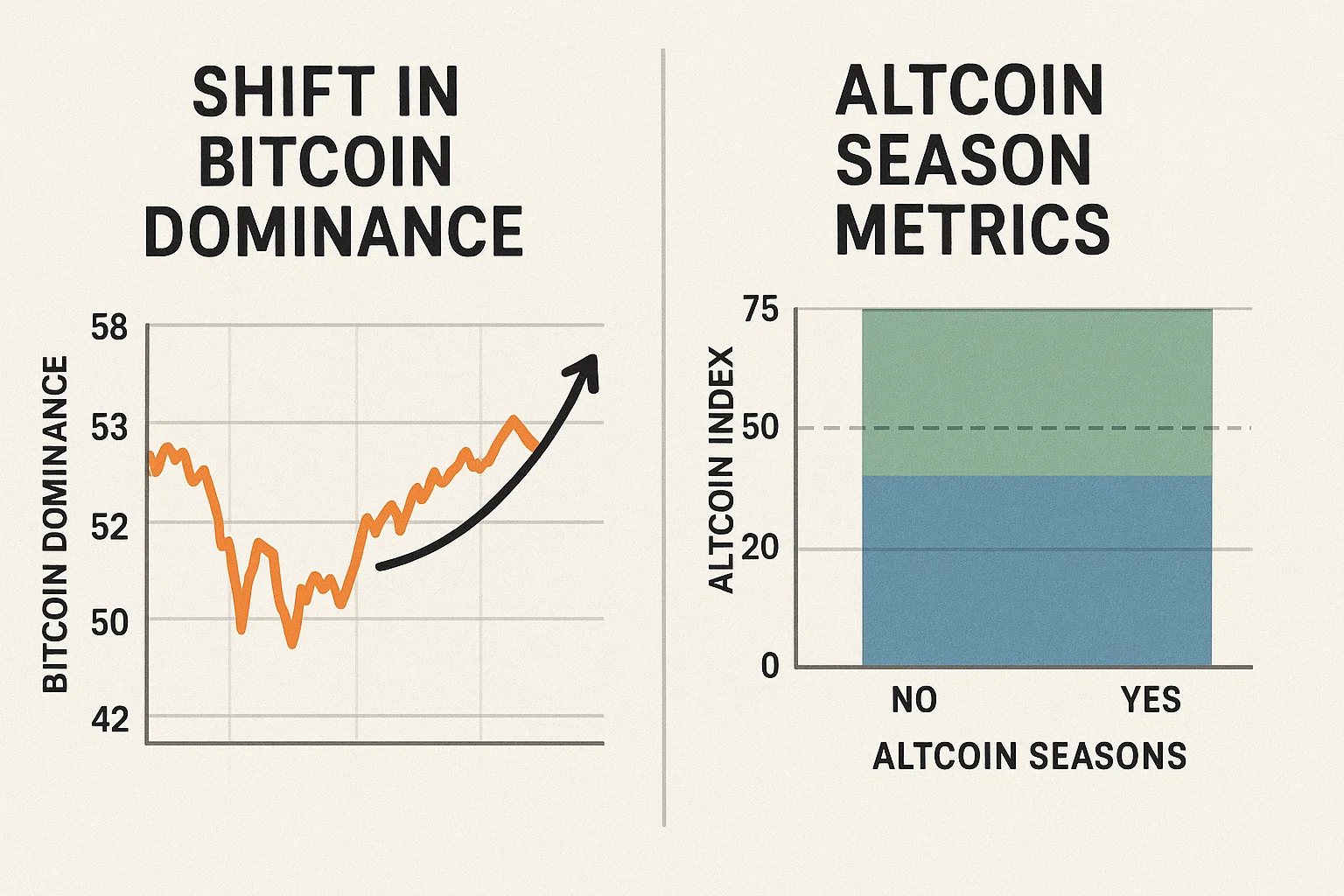

Shift in Bitcoin Dominance & Altcoin Season Metrics

One way to measure breadth is through metrics such as the Altcoin Season Index and Bitcoin dominance ratio. The Altcoin Season Index gauges how many top altcoins outperform Bitcoin over a rolling period. Historically, when this index rises meaningfully, it signals that the market is shifting from a Bitcoin‑led phase into a more altcoin‑friendly phase.

One way to measure breadth is through metrics such as the Altcoin Season Index and Bitcoin dominance ratio. The Altcoin Season Index gauges how many top altcoins outperform Bitcoin over a rolling period. Historically, when this index rises meaningfully, it signals that the market is shifting from a Bitcoin‑led phase into a more altcoin‑friendly phase.

Although Bitcoin remains dominant, the fact that more altcoins are participating indicates that breadth is improving. This shift reduces the single‑asset risk and suggests that a broader cycle may be gaining momentum.

What’s Driving the Improvement in Market Breadth?

With the observation that breadth is improving, it’s important to analyse the underlying drivers behind this phenomenon. Why are altcoins beginning to move with Bitcoin now?

Macro & Risk‑Appetite Environment

Macro‑economic developments and broader risk‑appetite shifts play a critical role in the crypto market. For instance, reports that the U.S. government shutdown may be ending helped lift risk sentiment and encouraged entry into risk assets, including crypto.

When investors move from capital preservation into risk‑taking mode, money often flows into assets beyond just the largest and most obvious plays. As liquidity conditions improve and sentiment turns constructive, altcoins get included in the rotation. The improving breadth reflects the extension of risk appetite from Bitcoin into secondary assets.

Institutional Flows, On‑Chain Signals and DeFi Engagement

Another driver is the dynamics of on‑chain liquidity, exchange flows, decentralised finance (DeFi) activity, and ETF or institutional participation. The improvement in breadth is supported by rising on‑chain engagement for multiple cryptocurrencies and not just one. In the market‑breadth article, the authors noted that improvements in large‑cap and mid‑cap altcoin participation coincide with the broader recovery.

DeFi protocols, staking, and infrastructure layer‑1 tokens provide utility beyond mere speculation. As these tokens regain momentum, they help deepen the breadth of the market. One source pointed out that the total value locked and active wallet numbers in alt networks are key to sustained breadth.

Rotation and Diversification among Crypto Traders

In mature markets, once Bitcoin has had its run, capital often begins seeking other opportunities—this is a rotation into altcoins. When traders and investors begin to diversify beyond the “haven” of Bitcoin, the breadth of the crypto rally extends. This rotation is part of what creates improved market breadth: more assets above water, more sectors participating, more narratives engaged. The fact that altcoins are showing signs of life alongside Bitcoin supports this thesis.

Implications for Investors & Traders

Understanding that crypto market breadth is improving and altcoins are joining the Bitcoin rebound is valuable—but what does it mean practically for investors and traders?

Portfolio Construction & Risk Distribution

For longer‑term investors, the shift in breadth suggests that allocations may begin to widen beyond just Bitcoin. While Bitcoin has been the primary store of value in the crypto space, improved altcoin participation means a broader array of opportunities may be opening. Diversifying into altcoins (with caution) could capture more of the upside if the breadth holds. However, one must remain aware that improving breadth does not equate to a guaranteed altcoin season or avoiding risk.

Short‑Term Trading Opportunities & Rotational Dynamics

For traders, improved breadth signals that trading strategies can move beyond a Bitcoin‑only focus. Rotational trades between Bitcoin and altcoins may pick up. When altcoins start showing strength, tracking the early movers and momentum plays can be more fruitful. The fact that breadth is improving means the market is less dependent on one asset and more open to breakout opportunities in secondary cryptocurrencies.

Caution – Not All Altcoins Are Equal

Although market breadth is improving, it does not imply uniform recovery across all altcoins. Selection is key. Many altcoins may remain stagnant while a subset participates in the rebound. Investors and traders should scrutinize fundamentals, liquidity, tokenomics, and network activity before assuming a broad altcoin rally is underway. Also, macro‑tailwinds and liquidity conditions remain key; if those reverse, breadth may contract quickly.

What Could Go Wrong – Risks to the Breadth Narrative

While the narrative of broader market breadth is positive, several risks could derail or reverse it. Understanding these risks is essential for balanced positioning.

Macro or Liquidity Setbacks

Since cryptocurrency markets are sensitive to macro conditions and liquidity flows, any reversal in risk sentimentsuch as a hawkish shift in monetary policy, a geopolitical shock, or a liquidity drain, could first impact altcoins more severely than Bitcoin. Breadth often contracts quickly when external conditions worsen.

Rotation Doesn’t Always Lead to Sustained Breadth

Rotation into altcoins can be ephemeral. If Bitcoin begins to dominate again (i.e., its dominance ratio increases,s), the breadth may shrink. Historical cycles show that altcoin outperformance often follows a defined shift, and unless rotation is sustained, the advantage can reverse. One reference noted that the Altcoin Season Index remained low at ~25 out of 100, indicating that despite improvement, we may not yet be in a full‑fledged alt season.

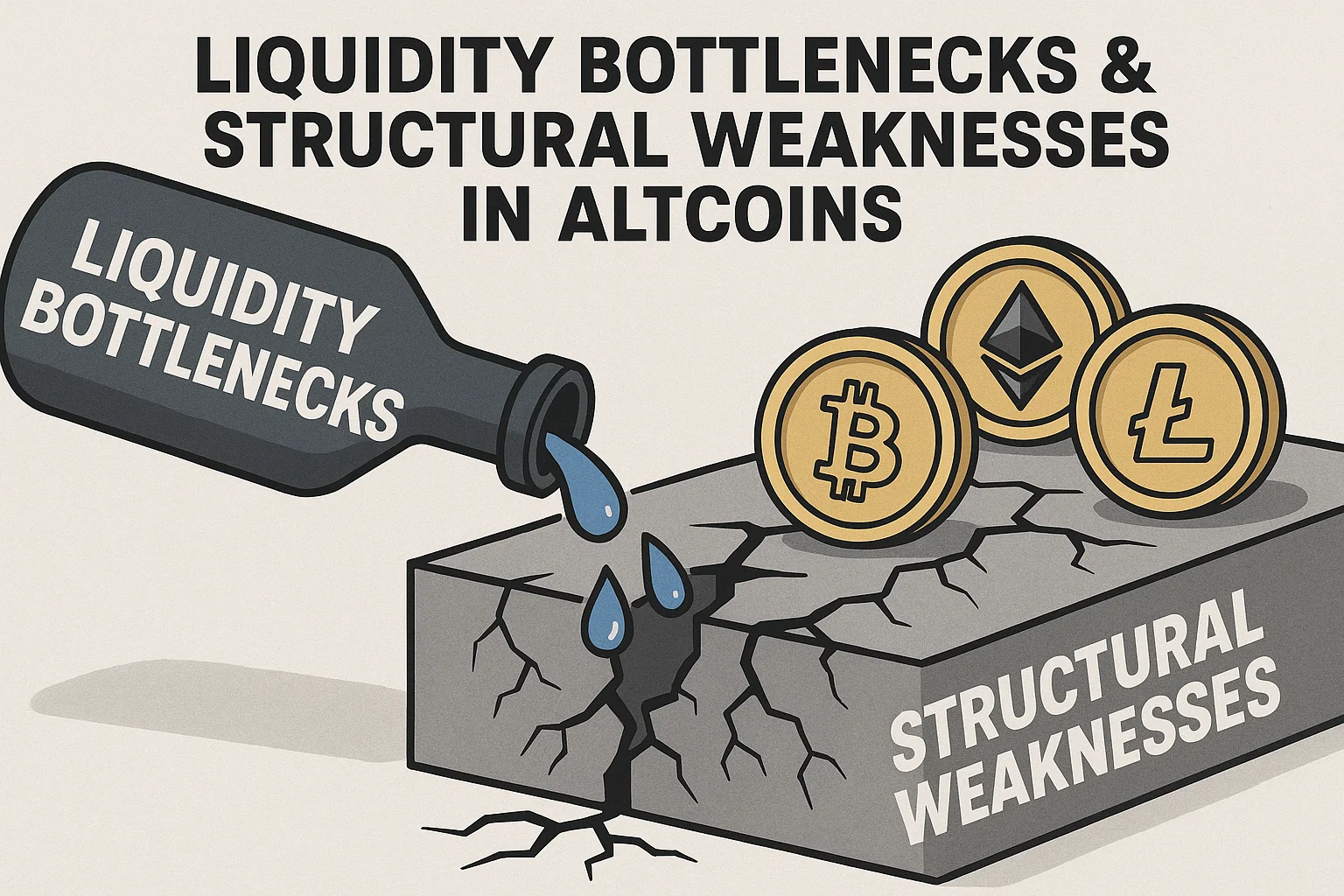

Liquidity Bottlenecks & Structural Weaknesses in Altcoins

Altcoins often suffer from weaker liquidity, smaller market caps, and higher volatility. Even if breadth improves, a shock may hit the most vulnerable tokens first. Hence, while breadth is improving, it remains fragile until it is backed by structural fundamentals such as robust network usage, strong token util, and resilient capital flows.

Altcoins often suffer from weaker liquidity, smaller market caps, and higher volatility. Even if breadth improves, a shock may hit the most vulnerable tokens first. Hence, while breadth is improving, it remains fragile until it is backed by structural fundamentals such as robust network usage, strong token util, and resilient capital flows.

Looking Ahead: What to Watch for Next

Given that the crypto market is showing signs of broader participation, what should market participants monitor to assess whether the trend holds or falters?

Metrics of Breadth and Dominance

Watch key metrics like Bitcoin dominance (its percentage of total crypto market cap), altcoin outperformance statistics (via the Altcoin Season Index or similar), and the proportion of large‑cap altcoins showing positive price action. A sustained decline in Bitcoin dominance, combined with broad altcoin gains, is a hallmark of improved breadth.

On‑chain and Institutional Flow Signals

Monitor flows into exchanges/outflows across multiple tokens, DeFi activity, staking metrics, and ETF or institutional investment data (especially in Bitcoin and major altcoins). If these flows expand across sectors, the breadth is more credible. One report linked improved altcoin participation with institutional flows and liquidity shifts.

Macro Tailwinds and Risk Environment

Since breadth depends on risk appetite and liquidity, macro developments such as interest rates, inflation data, regulatory clarity, and broader asset‑class sentiment will matter. An improving macro environment supports the breadth narrative; a deteriorating one could inhibit it.

Key Altcoin Catalysts and Narrative Shifts

Look for narrative drivers that can lift altcoins beyond mere rotation—for instance, breakthroughs in layer‑1 networks, DeFi innovations, large project launches, or institutional adoption of alt tokens. These will give altcoins independent strength rather than just following Bitcoin’s lead.

Conclusion

The observation that crypto market breadth improves as altcoins join the Bitcoin rebound is a meaningful signal in the digital‑asset ecosystem. It suggests that the rally is not solely confined to Bitcoin and that the wider market may begin to participate in growth. This shift offers both opportunities and risks: broader participation can lead to a more sustainable recovery, but it also invites heightened vulnerability if macro or liquidity conditions reverse.

For investors and traders, this development opens room for portfolio diversification, rotational strategies, and deeper market engagement beyond Bitcoin alone. However, caution remains warranted: improved breadth does not guarantee an altcoin explosion, and structural fundamentals alongside macro factors must align for breadth to truly mature.

As you navigate this evolving landscape, keep a close eye on dominance metrics, institutional and on‑chain flows, macro cues, and narrative catalysts across altcoins. The breadth is improving—but its durability will depend on multiple variables coming together.

FAQs

Q. What is meant by ‘market breadth’ in the crypto context?

Market breadth refers to how widely price gains or losses are spread across the cryptocurrency ecosystem, including altcoins, rather than being concentrated in a few large assets like Bitcoin. Strong breadth implies broader participation and potentially more sustainable momentum.

Q. How can we tell if altcoins are genuinely joining a rebound rather than temporarily moving?

Indicators include sustained outperformance of altcoins relative to Bitcoin (via the Altcoin Season Index), declining Bitcoin dominance, rising trading volume and liquidity across altcoins, increased on‑chain activity, and institutional or large‑holder flows into non‑Bitcoin assets.

Q. Does improved market breadth mean we are in an “altcoin season”?

Not necessarily. Improved breadth is a positive sign, but “altcoin season” traditionally refers to a period when altcoins significantly outperform Bitcoin for an extended stretch. Breadth improvement can be an early signal, but full alt season requires more sustained structural support and rotation.

Q. What should investors consider if they want to take advantage of the breadth shift?

Investors should consider diversifying beyond Bitcoin into high‑quality altcoins, but with careful due diligence on fundamentalsliquidityity and risk. They should also monitor macro and liquidity conditions, keep portfolio exposure at a table le, and use risk management whether in short‑term trades or longer‑term holdings.

Q. What are the major risks that could reverse the improved breadth?

Key risks include macro or liquidity setbacks (such as rate hikes or risk‑off sentiment), Bitcoin dom reasserting itself (leading to contraction in altcoin participation), structural weakness in altcoins (poor liquidity or low utility), and the possibility that rotation into altcoins is superficial rather than foundational.

Read MoreCrypto Trading Platform Trade Smarter in 2025