Polkadot Price Prediction Forecast DOT price in 2025

The cryptocurrency market continues to evolve at breakneck speed, with innovative blockchain projects capturing the attention of investors and technology enthusiasts worldwide. Among these groundbreaking platforms, Polkadot (DOT) stands as one of the most promising multi-chain protocols, designed to enable seamless interoperability between different blockchain networks. As we move into 2025, many investors and crypto enthusiasts are asking the critical question: what does the future hold for DOT price prediction 2025?

Polkadot’s revolutionary approach to blockchain technology has positioned it as a potential game-changer in the decentralized ecosystem. Created by Ethereum co-founder Dr. Gavin Wood, Polkadot addresses one of the most significant challenges in the blockchain space – the lack of communication between different networks. This unique value proposition has made DOT token a subject of intense speculation and analysis among cryptocurrency traders and long-term investors.

The Polkadot network operates on a sophisticated architecture that includes a relay chain, parachains, and bridges, creating an interconnected web of blockchains that can share information and transactions seamlessly. This technological innovation has not only attracted developers and projects to build on the platform but has also generated significant interest from institutional investors and retail traders looking for the next big opportunity in the crypto space.

Polkadot price movements requires a comprehensive analysis of multiple factors, including technological developments, market sentiment, adoption rates, competition, and broader macroeconomic conditions. The DOT cryptocurrency has experienced significant volatility since its launch, with prices fluctuating based on network upgrades, partnership announcements, and overall market trends.

As we delve into this detailed Polkadot price prediction 2025 analysis, we’ll examine the fundamental and technical factors that could influence DOT’s price trajectory. From analyzing the project’s roadmap and upcoming developments to market dynamics and investor sentiment, this comprehensive guide aims to provide valuable insights for anyone interested in DOT price forecast scenarios.

Polkadot’s Fundamentals

What Makes Polkadot Unique in the Blockchain Ecosystem

Polkadot’s architecture represents a paradigm shift in how blockchain networks can interact and collaborate. Unlike traditional blockchains that operate in isolation, Polkadot’s relay chain serves as the network’s heart, coordinating communication and transactions between connected parachains. This innovative design allows for unprecedented scalability and specialization, where each parachain can be optimized for specific use cases while maintaining security through the shared relay chain.

The DOT token economics play a crucial role in the network’s security and governance. DOT holders can participate in network governance by voting on protocol upgrades and changes, stake their tokens to secure the network through nominated proof-of-stake (NPoS) consensus, and bond DOT tokens to lease parachain slots. This multi-faceted utility creates various demand drivers for the token beyond speculative trading.

Polkadot’s scalability solutions address one of the most pressing issues in the blockchain space. While Ethereum processes approximately 15 transactions per second, Polkadot’s parallel processing capability through parachains can theoretically handle thousands of transactions per second. This scalability advantage positions Polkadot as a viable alternative for high-throughput applications and enterprise adoption.

The Role of Parachains in DOT’s Value Proposition

Parachain auctions represent a unique mechanism for determining which projects can secure a slot on the Polkadot network. These auctions create natural demand for DOT tokens as projects must bond significant amounts of DOT to participate. The parachain slot auctions have historically led to increased buying pressure and price appreciation for the DOT cryptocurrency.

The success of parachain projects directly impacts Polkadot’s overall value proposition. As more innovative projects launch on parachains and demonstrate real-world utility, the entire ecosystem benefits from increased adoption and network effects. Projects like Acala, Moonbeam, and Astar have already begun showcasing the potential of specialized blockchains operating within the Polkadot ecosystem.

Cross-chain functionality enabled by Polkadot’s architecture opens up new possibilities for decentralized finance (DeFi), non-fungible tokens (NFTs), and other blockchain applications. This interoperability allows users to leverage the best features of different blockchains without being locked into a single ecosystem, creating a more flexible and user-friendly crypto experience.

Technical Analysis of DOT Price Trends

Historical Price Performance and Patterns

Analyzing DOT price history reveals several distinct phases in the token’s journey. From its initial launch in 2020 to its all-time high in late 2021, DOT experienced explosive growth driven by market euphoria and growing recognition of Polkadot’s technological capabilities. These historical patterns provides valuable context for DOT price prediction 2025 scenarios.

The Polkadot market cycle has shown strong correlation with broader cryptocurrency market trends while maintaining some unique characteristics. During bull markets, DOT has often outperformed major cryptocurrencies like Bitcoin and Ethereum, suggesting strong investor confidence in the project’s long-term potential. Conversely, during bear markets, DOT has also experienced significant corrections, highlighting the importance of risk management for investors.

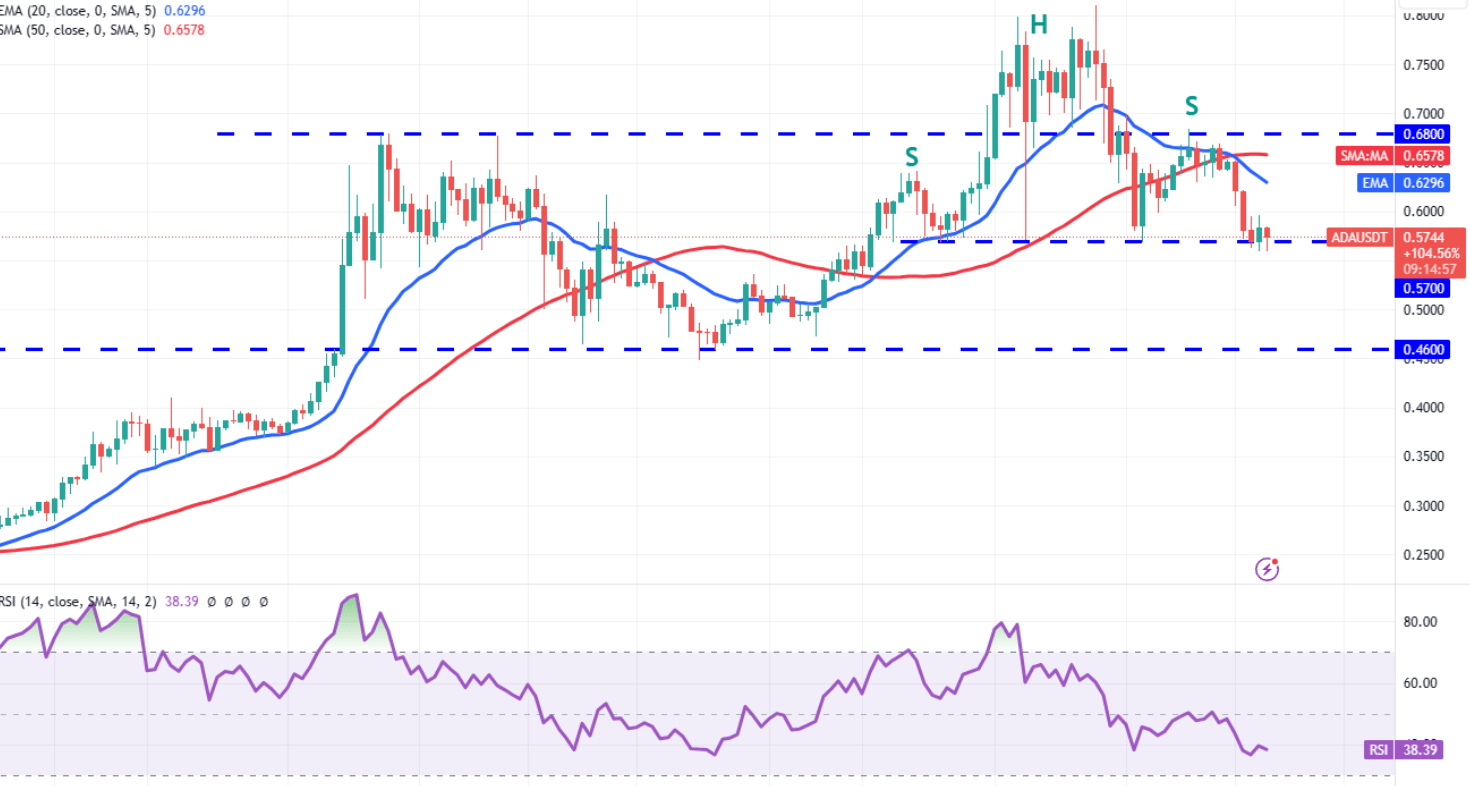

Technical indicators for DOT suggest various support and resistance levels that could influence future price movements. Moving averages, relative strength index (RSI), and Fibonacci retracement levels provide insights into potential entry and exit points for traders. The token’s technical analysis also reveals patterns that could repeat in future market cycles.

Key Support and Resistance Levels

DOT support levels have been established at various price points based on historical trading data and market psychology. These levels often coincide with significant round numbers, previous high points, or technical indicator confluences. These support zones is crucial for predicting potential bounce areas during market corrections.

Resistance levels for DOT represent price points where selling pressure has historically outweighed buying pressure. Breaking through these resistance levels often leads to significant price movements and can signal the beginning of new uptrends. The identification of key resistance levels helps traders and investors plan their strategies accordingly.

Volume analysis provides additional confirmation for technical analysis signals. High volume breakouts above resistance levels or bounces from support levels carry more significance than low-volume movements. The relationship between price action and trading volume offers insights into the strength and sustainability of price trends.

Fundamental Analysis: Factors Affecting DOT Price

Network Development and Technological Upgrades

Polkadot development roadmap includes several major upgrades and improvements scheduled for 2025. These technological enhancements could significantly impact the network’s capabilities and, consequently, the DOT token value. Upgrades focusing on scalability, security, and user experience often catalyze positive price movements in the cryptocurrency market.

The developer ecosystem surrounding Polkadot continues to expand, with increasing numbers of projects choosing to build on the platform. This developer adoption translates to increased network usage, token demand, and overall ecosystem growth. The strength of the developer community often serves as a leading indicator for long-term project success.

Partnership announcements and collaborations with major technology companies, financial institutions, or government entities can significantly impact DOT price prediction 2025 scenarios. These partnerships often validate the technology and increase mainstream adoption, leading to increased investor confidence and token demand.

Market Adoption and Use Cases

Enterprise adoption of Polkadot technology represents a significant growth driver for DOT token demand. As more companies recognize the benefits of blockchain interoperability and begin implementing Polkadot-based solutions, the network’s utility and token demand naturally increase. Real-world use cases demonstrate the practical value of the technology beyond speculative trading.

DeFi integration within the Polkadot ecosystem has created new use cases and demand drivers for DOT tokens. Decentralized finance protocols built on Polkadot parachains often require DOT for various functions, including liquidity provision, governance participation, and collateral backing. The growth of DeFi on Polkadot directly correlates with increased token utility.

Institutional investment in DOT represents another crucial factor for price appreciation. As institutional investors increasingly recognize cryptocurrency as a legitimate asset class, projects with strong fundamentals like Polkadot often attract significant capital inflows. Institutional adoption typically leads to reduced volatility and more stable long-term price growth.

Market Sentiment and External Factors

Regulatory Environment Impact

The regulatory landscape for cryptocurrencies continues to evolve, with potential implications for Polkadot price prediction 2025. Clear regulatory frameworks often boost investor confidence and encourage institutional participation, while regulatory uncertainty can create headwinds for price appreciation. Polkadot’s focus on compliance and regulatory cooperation positions it well for evolving regulatory requirements.

Government adoption of blockchain technology, particularly interoperability solutions, could significantly benefit Polkadot. As governments explore central bank digital currencies (CBDCs) and other blockchain applications, the need for interoperable systems becomes increasingly apparent. Polkadot’s technology stack addresses many requirements for government and institutional blockchain implementations.

Industry trends toward blockchain interoperability align perfectly with Polkadot’s core value proposition. As the cryptocurrency industry matures, the ability to seamlessly transfer assets and data between different blockchains becomes increasingly valuable. This trend positions Polkadot as a beneficiary of the industry’s natural evolution toward greater connectivity.

Competition Analysis

Competing platforms in the interoperability space include Cosmos, Avalanche, and various Layer 2 solutions. Analyzing the competitive landscape helps assess Polkadot’s relative position and potential market share. Each platform offers unique advantages and trade-offs, and these differences is crucial for DOT price forecast accuracy.

Market differentiation strategies employed by Polkadot include its unique shared security model, sophisticated governance system, and focus on true interoperability rather than mere multi-chain support. These differentiating factors could help Polkadot maintain its competitive edge and justify premium valuations compared to competitors.

Innovation pace within the interoperability sector remains rapid, with new solutions and improvements regularly emerging. Polkadot’s ability to continue innovating and maintaining technological leadership will significantly impact its long-term price potential and market position.

DOT Price Prediction Models for 2025

Conservative Scenario Analysis

In a conservative DOT price prediction 2025 scenario, we assume moderate growth driven by steady development progress and gradual market adoption. This scenario considers potential regulatory challenges, market competition, and normal market volatility. Conservative estimates typically appeal to risk-averse investors seeking realistic return expectations.

Factors supporting conservative growth include consistent development progress, gradual enterprise adoption, and stable regulatory environments. This scenario assumes DOT maintains its current market position while experiencing modest appreciation aligned with overall cryptocurrency market growth. Risk management considerations favor this conservative approach for portfolio planning.

Price targets in conservative scenarios often reflect sustainable growth rates based on historical performance and fundamental improvements. These targets consider both upside potential and downside risks, providing a balanced perspective for investment decision-making.

Optimistic Growth Scenarios

Optimistic DOT price predictions for 2025 assume accelerated adoption, major partnership announcements, and favorable market conditions. This scenario envisions Polkadot capturing significant market share in the interoperability sector and benefiting from broader cryptocurrency market growth. Optimistic scenarios appeal to growth-oriented investors willing to accept higher risks for potentially higher returns.

Catalysts for optimistic growth include breakthrough technological developments, major enterprise partnerships, regulatory clarity, and increased institutional investment. These factors could combine to create significant upward pressure on DOT prices, potentially leading to substantial appreciation beyond historical norms.

Bull market conditions could amplify Polkadot’s growth potential, as cryptocurrency bull markets often disproportionately benefit innovative projects with strong fundamentals. During such periods, DOT token could experience exponential growth as investor enthusiasm and speculation drive prices higher.

Bearish Scenario Considerations

Bearish scenarios for Polkadot price prediction 2025 consider potential headwinds including increased competition, regulatory challenges, technical difficulties, or broader market downturns. These scenarios help investors understand downside risks and prepare appropriate risk management strategies.

Risk factors that could negatively impact DOT prices include delayed development milestones, security vulnerabilities, competitive disadvantages, or loss of market confidence. These risks is essential for comprehensive investment analysis and portfolio risk management.

Market correction scenarios could significantly impact DOT prices, particularly if broader cryptocurrency markets experience substantial declines. Historical analysis shows that altcoins often experience amplified volatility during market corrections, making risk assessment crucial for DOT investors.

Investment Strategies and Risk Management

Long-term Investment Approach

Long-term DOT investment strategies focus on the fundamental value proposition of blockchain interoperability and Polkadot’s technological advantages. This approach requires patience and conviction in the project’s long-term potential while weathering short-term market volatility. Long-term investors often benefit from dollar-cost averaging and strategic accumulation during market downturns.

Portfolio allocation considerations for DOT should account for risk tolerance, investment objectives, and correlation with other cryptocurrency holdings. Diversification across multiple cryptocurrencies and traditional assets helps manage overall portfolio risk while maintaining exposure to DOT’s growth potential.

Staking strategies for DOT provide additional income streams while supporting network security. Staking rewards can enhance total returns for long-term holders, though they require of lock-up periods and slashing risks. The compound effect of staking rewards can significantly impact long-term investment outcomes.

Short-term Trading Considerations

Short-term DOT trading requires active monitoring of technical indicators, market sentiment, and news events that could impact price movements. Traders must develop systematic approaches to entry and exit points while managing risk through position sizing and stop-loss orders.

Volatility management becomes crucial for short-term DOT positions, as cryptocurrency markets can experience rapid price movements. Volatility patterns and implementing appropriate risk management techniques helps preserve capital during adverse market conditions.

Market timing strategies for DOT trading should consider broader cryptocurrency market cycles, news events, and technical analysis signals. Successful timing requires discipline, experience, and the ability to adapt to changing market conditions.

Also Read: Top 10 Explosive Altcoins with High Potential for 2025

Conclusion

The Polkadot price prediction 2025 landscape presents a complex mixture of opportunities and challenges that require careful analysis and consideration. Throughout this comprehensive examination, we’ve explored the fundamental strengths that position DOT token as a potentially valuable investment, including its innovative interoperability technology, growing parachain ecosystem, and increasing adoption across various sectors.

Polkadot’s technological advantages in addressing blockchain fragmentation and enabling seamless cross-chain communication create a compelling value proposition that could drive significant price appreciation in 2025. The network’s unique architecture, combined with its proven ability to attract high-quality projects through parachain auctions, establishes a strong foundation for long-term growth.

However, investors must also acknowledge the inherent risks and uncertainties surrounding DOT price forecast scenarios. Market volatility, regulatory developments, competitive pressures, and execution risks could all impact the token’s performance. The cryptocurrency market’s cyclical nature and correlation with broader economic conditions add additional layers of complexity to any price prediction model.

Market sentiment and external factors will likely play crucial roles in determining DOT’s price trajectory in 2025. Positive developments such as major partnership announcements, technological breakthroughs, or favorable regulatory clarity could catalyze significant price movements, while negative events could create temporary setbacks.

The range of possible outcomes for Polkadot price prediction 2025 reflects both the enormous potential and inherent uncertainty in the cryptocurrency market. Conservative scenarios suggest steady, sustainable growth driven by fundamental improvements and gradual adoption. Optimistic scenarios envision dramatic price appreciation fueled by accelerated adoption and favorable market conditions. Bearish scenarios remind us of the downside risks that could impact investment returns.

Investment strategies for DOT should align with individual risk tolerance, investment objectives, and market outlook. Long-term investors may benefit from dollar-cost averaging and strategic accumulation, while short-term traders might focus on technical analysis and market timing. Regardless of approach, proper risk management remains essential for navigating the volatile cryptocurrency landscape.