Cryptocurrency Security Best Practices Complete 2025 Protection Guide

The world of digital currencies has revolutionized finance, but with great opportunity comes great responsibility for security. Cryptocurrency security best practices are no longer optional—they’re absolutely essential for anyone holding digital assets. As cyber threats become more sophisticated and cryptocurrency adoption grows exponentially, protecting your investments requires a comprehensive understanding of security fundamentals and advanced protection strategies.

Unlike traditional banking where institutions provide safety nets, cryptocurrency operates in a decentralized environment where you are your own bank. This means implementing robust cryptocurrency security best practices is the only way to ensure your digital wealth remains safe from hackers, scammers, and technical failures. This guide provides actionable strategies that both newcomers and experienced traders can implement to create an impenetrable security framework around their cryptocurrency holdings.

The Foundation of Crypto Asset Protection

Understanding the Threat Landscape

The cryptocurrency ecosystem faces unique security challenges that don’t exist in traditional finance. Hackers specifically target crypto holders because transactions are irreversible and often pseudonymous, making recovery nearly impossible once funds are stolen. Common attack vectors include sophisticated phishing campaigns, malware designed to steal wallet files, social engineering tactics targeting customer support systems, and SIM swapping attacks that compromise two-factor authentication.

Understanding these threats helps you develop appropriate countermeasures. Cybercriminals continuously evolve their tactics, using artificial intelligence to create more convincing phishing emails and developing malware that can remain undetected for extended periods. The decentralized nature of cryptocurrency means there’s no central authority to reverse fraudulent transactions or recover stolen funds.

Building a Security-First Mindset

Developing proper security habits requires shifting from convenience-focused thinking to security-focused decision-making. Every action involving cryptocurrency should be evaluated through a security lens, from choosing wallets and exchanges to making transactions and storing backup information. This mindset becomes second nature with practice and can prevent costly security mistakes.

Security awareness extends beyond technical measures to include operational security practices. This means being cautious about discussing your cryptocurrency holdings publicly, using secure communication channels for crypto-related conversations, and maintaining privacy about your investment strategies and wallet addresses.

Comprehensive Wallet Security Strategies

Hardware Wallet Implementation and Best Practices

Hardware wallets represent the pinnacle of cryptocurrency security best practices for long-term storage. These dedicated devices store private keys in secure elements that are virtually impossible to extract, even with physical access to the device. Popular options include Ledger Nano S Plus, Trezor Model One, and KeepKey, each offering different features and supported cryptocurrencies.

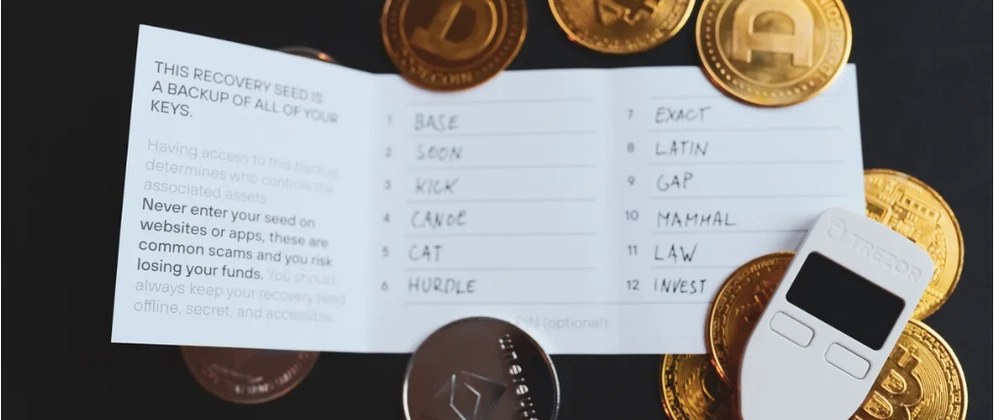

When setting up hardware wallets, generate seed phrases on the device itself rather than importing existing ones when possible. This ensures the private keys have never existed in a potentially compromised environment. Store the recovery seed phrase using metal backup plates that can withstand fire, water, and other disasters that might destroy paper backups.

Firmware updates for hardware wallets are crucial for maintaining security, as manufacturers regularly patch vulnerabilities and add new features. Always download firmware updates directly from the manufacturer’s official website and verify digital signatures when provided. Never update firmware through third-party sources or suspicious links.

Software Wallet Security Configuration

Software wallets offer convenience for frequent transactions but require careful security configuration to maintain protection levels. Choose wallets from reputable developers with transparent security practices and regular code audits. Open-source wallets allow security researchers to review code for vulnerabilities, providing additional confidence in their security implementations.

Enable all available security features including PIN codes, biometric authentication, and transaction confirmation requirements. Configure wallets to require manual confirmation for all outgoing transactions, preventing unauthorized automated transfers. Regular wallet backups ensure you can recover funds even if your device fails or is stolen.

Mobile wallet security requires additional considerations due to the inherent risks of portable devices. Use app-level passwords or biometric locks, enable remote wipe capabilities, and avoid storing large amounts in mobile wallets. Consider mobile wallets primarily for small transactions and daily use rather than long-term storage.

Advanced Authentication and Account Protection

Multi-Layered Authentication Systems

Implementing robust authentication systems forms a critical component of effective cryptocurrency security best practices. Traditional password-only authentication is insufficient for protecting valuable cryptocurrency accounts. Multi-factor authentication using time-based one-time passwords (TOTP) provides significantly better protection than SMS-based systems, which are vulnerable to SIM swapping attacks.

Hardware security keys offer the strongest authentication protection available. These physical devices must be present to complete login processes, making remote attacks virtually impossible. Major cryptocurrency exchanges increasingly support FIDO2/WebAuthn standards that enable hardware key authentication.

Consider implementing authentication hierarchies where different security levels are required for different actions. For example, basic account access might require password plus TOTP, while large withdrawals might additionally require hardware key confirmation and email verification.

Password Security and Management

Strong password practices remain fundamental to cryptocurrency security despite advanced authentication options. Use unique, complex passwords for every cryptocurrency-related account, generated by reputable password managers. Avoid reusing passwords across different services, as a breach at one service could compromise multiple accounts.

Password managers like Bitwarden, 1Password, or KeePass can generate and store complex passwords while providing convenient access across devices. Enable all security features in your password manager, including two-factor authentication and secure sharing capabilities for family or business cryptocurrency management.

Consider using passphrases for critical accounts, combining multiple random words to create memorable but secure credentials. The Electronic Frontier Foundation’s dice-generated wordlists provide excellent sources for creating strong passphrases that balance security with memorability.

Private Key and Seed Phrase Security Mastery

Secure Generation and Storage Protocols

Private key security represents the core of all cryptocurrency security best practices. Generate private keys and seed phrases using trusted, offline devices whenever possible. Air-gapped computers that have never been connected to the internet provide the highest security level for key generation, though this approach requires technical expertise to implement correctly.

Seed phrase storage requires careful planning and multiple backup strategies. Metal backup plates resist fire, water, and corrosion better than paper, making them ideal for long-term storage. Companies like Cryptosteel and Billfodl offer purpose-built seed phrase storage solutions that can withstand extreme conditions.

Consider implementing secret sharing schemes where your seed phrase is split across multiple locations or trusted individuals. Shamir’s Secret Sharing allows you to create multiple shares of your seed phrase, where a subset of shares can recover the complete phrase. This approach provides redundancy while maintaining security if individual shares are compromised.

Advanced Key Management Techniques

Multi-signature wallets provide enhanced security by requiring multiple private keys to authorize transactions. This distributed approach means no single point of failure can compromise your funds. Multi-sig implementations range from simple 2-of-3 configurations to complex corporate treasury management systems with sophisticated approval workflows.

Time-locked transactions and hierarchical deterministic (HD) wallets offer additional security layers for advanced users. HD wallets generate multiple addresses from a single seed phrase, improving privacy while simplifying backup procedures. Time-locked transactions can prevent immediate spending of received funds, providing additional verification time for large transactions.

Exchange Security and Trading Protection

Comprehensive Exchange Evaluation

Choosing secure cryptocurrency exchanges requires thorough research beyond basic reputation checks. Evaluate exchanges based on security audit results, insurance coverage for customer funds, regulatory compliance in relevant jurisdictions, and transparency about security practices. Exchanges that publish regular proof-of-reserves reports demonstrate commitment to transparency and customer protection.

Security certifications from organizations like SOC 2 Type II indicate that exchanges undergo rigorous third-party security evaluations. While certifications don’t guarantee security, they provide additional confidence in an exchange’s security practices and procedures.

Trading Account Hardening

Configure exchange accounts with maximum security settings enabled from day one. This includes withdrawal address whitelisting, which restricts fund transfers to pre-approved addresses, and time-delayed withdrawals that provide additional verification windows for large transactions. Enable email and SMS notifications for all account activities to quickly detect unauthorized access attempts.

API key security is crucial for users employing trading bots or portfolio management tools. Limit API permissions to only necessary functions, never enable withdrawal permissions for API keys unless absolutely required, and regularly rotate API credentials. Monitor API usage logs for suspicious activity and disable unused keys immediately.

Transaction Security and Verification Methods

Robust Transaction Verification Protocols

Every cryptocurrency transaction requires careful verification before execution. Develop standardized procedures for confirming recipient addresses, transaction amounts, and network fees. Use address book features to store frequently used addresses, reducing manual entry errors and clipboard malware risks.

For significant transactions, implement multi-step verification processes. This might include sending small test amounts first, using multiple devices to verify transaction details, and implementing cooling-off periods for large transfers. While these procedures add complexity, they provide valuable protection against costly mistakes and sophisticated attacks.

Network and Mempool Security Considerations

Understanding blockchain network dynamics helps optimize both security and transaction efficiency. Monitor network congestion and fee markets to avoid overpaying for transactions while ensuring timely confirmation. Use reputable block explorers to verify transaction status and confirm successful completion.

Replace-by-fee (RBF) and child-pays-for-parent (CPFP) features can help resolve stuck transactions, but they also introduce security considerations. Understand how these features work and their implications before using them in critical transactions.

Advanced Threat Protection and Monitoring

Proactive Security Monitoring

Implement comprehensive monitoring systems to detect potential security threats before they result in losses. This includes setting up alerts for unusual account activities, monitoring your addresses on blockchain explorers for unexpected transactions, and using portfolio tracking tools that can alert you to unauthorized movements.

Consider using specialized cryptocurrency security services that monitor the dark web for stolen credentials or planned attacks targeting your addresses. These services can provide early warnings about potential threats, allowing you to take protective action before attacks occur.

Incident Detection and Response

Develop detailed incident response procedures that outline specific steps to take when security breaches are detected or suspected. This includes immediate account security measures, fund protection protocols, evidence preservation for potential legal action, and communication with relevant authorities and service providers.

Document all security incidents thoroughly, including timelines, affected accounts, and response actions taken. This documentation helps improve future security procedures and provides necessary information for insurance claims or law enforcement investigations.

Mobile and Desktop Security Hardening

Device-Level Security Implementation

Your devices represent the primary attack surface for cryptocurrency theft, making device security a cornerstone of cryptocurrency security best practices. Implement full-disk encryption on all devices used for cryptocurrency activities, use strong device passwords or biometric authentication, and enable automatic security updates for operating systems and applications.

Consider using dedicated devices or virtual machines exclusively for cryptocurrency activities. This isolation approach prevents cross-contamination from other applications and reduces the attack surface available to malicious software. Virtual machines can provide similar benefits when dedicated hardware isn’t practical or cost-effective.

Regular security maintenance includes monitoring running processes for suspicious activity, reviewing installed applications for potential malware, and performing comprehensive security scans using multiple antivirus solutions. Keep device software minimal, installing only necessary applications to reduce potential attack vectors.

Mobile Security Considerations

Mobile devices require additional security measures due to their portability and connectivity patterns. Enable remote wipe capabilities through device management systems, use mobile device management (MDM) solutions for business crypto activities, and avoid storing significant amounts in mobile wallets.

App store security varies significantly across platforms, so research wallet applications thoroughly before installation. Verify developer identities, read user reviews carefully, and check application permissions to ensure they align with stated functionality. Avoid side-loading applications from unofficial sources, as these often contain malware.

Privacy and Anonymity Protection

Blockchain Analysis and Privacy Considerations

Understanding blockchain analysis techniques helps protect your privacy while following cryptocurrency security best practices. Most blockchains are pseudonymous rather than anonymous, meaning transactions can potentially be traced back to real-world identities through various analysis techniques.

Use privacy-focused practices like address rotation, coin mixing services (where legal), and privacy coins for transactions requiring enhanced anonymity. However, ensure these practices comply with local regulations, as some jurisdictions restrict or prohibit certain privacy-enhancing techniques.

Communication and Information Security

Protect your privacy by being cautious about cryptocurrency-related communications and social media activities. Avoid discussing specific holdings, wallet addresses, or trading strategies publicly. Use secure communication channels for crypto-related conversations and be wary of social engineering attempts through social media platforms.

Consider using separate email addresses and phone numbers for cryptocurrency accounts to limit cross-service correlation and reduce exposure to targeted attacks. This compartmentalization helps contain potential breaches and makes it harder for attackers to build comprehensive profiles of your crypto activities.

Estate Planning and Legacy Protection

Cryptocurrency Inheritance Planning

Developing inheritance plans for cryptocurrency holdings requires balancing security with accessibility for beneficiaries. Traditional estate planning methods may not adequately address the unique challenges of cryptocurrency inheritance, such as private key access and technical complexity.

Consider using multi-signature wallets for estate planning, where trusted family members or legal representatives hold additional keys required for fund access. Document clear instructions for accessing and managing cryptocurrency holdings, including wallet types, exchange accounts, and security procedures.

Legal and Tax Considerations

Stay informed about cryptocurrency regulations and tax obligations in your jurisdiction, as these requirements can impact security practices and record-keeping procedures. Maintain detailed transaction records using secure, encrypted storage methods that protect sensitive information while meeting legal requirements.

Work with cryptocurrency-experienced legal and tax professionals who understand both regulatory requirements and security implications. These professionals can help structure your holdings and security practices to comply with regulations while maintaining optimal protection.

Future Security Developments and Preparation

Emerging Security Technologies

The cryptocurrency security landscape continues evolving with new technologies and methodologies. Quantum-resistant cryptography development addresses potential future threats from quantum computing advances. Multi-party computation (MPC) wallets distribute private key material across multiple parties, eliminating single points of failure.

Decentralized identity solutions and zero-knowledge proof systems offer new approaches to authentication and privacy that could significantly enhance cryptocurrency security. Stay informed about these developments while maintaining proven security practices until new technologies achieve widespread adoption and testing.

Continuous Security Education

Cryptocurrency security best practices evolve rapidly as new threats emerge and countermeasures develop. Subscribe to reputable security publications, follow blockchain security researchers on social media, and participate in cryptocurrency security communities to stay informed about emerging threats and best practices.

Regular security education helps you adapt your practices as the ecosystem evolves. Attend webinars, read security reports, and consider formal cybersecurity training to deepen your understanding of protection strategies and threat mitigation techniques.

Also Read: Cryptocurrency Legal Compliance Consulting Expert Guide for 2025

Conclusion

Mastering cryptocurrency security best practices is an ongoing journey that requires dedication, continuous learning, and careful implementation of proven security measures. The strategies outlined in this comprehensive guide provide a robust framework for protecting your digital assets against current and emerging threats. Remember that security is not a one-time setup but an ongoing process that must evolve with the cryptocurrency ecosystem.

The investment you make in implementing proper security measures today will pay dividends in peace of mind and asset protection for years to come. Start by implementing the fundamental practices discussed here, then gradually add advanced security layers as your comfort level and technical expertise grow.