XRP Faces Whale Sell-Off Threatening $2 Support Level

XRP Faces whale sell-off Volatility has once more rocked the bitcoin market; an XRP Faces whale sell-off is at the core of it this time. A significant sell-off by whales—investors carrying significant XRP—has rocked the market and pushed XRP dangerously near to losing its $2 support level. Analyzers and investors are attentively observing whether the asset can rebound or if more suffering is on the horizon as about $800 million worth of XRP dumps onto the market in a few days.

XRP Whale Selloff

On-chain statistics during the previous week have shown that the XRP whale sell-off sold out almost 370 million tokens, valued at almost $800 million. Through several sizable transactions involving previously dormant wallets, these sell-offs imply a concerted movement or maybe fear-driven liquidation.

From recent highs of almost $2.50 down to $2.10, this activity resulted in a notable 16% drop in XRP’s price. Technical analysts are warning that the $2 psychological support zone is in major risk as price levels swing. Should it fall, XRP might spiral down towards the next significant support at $1.65.

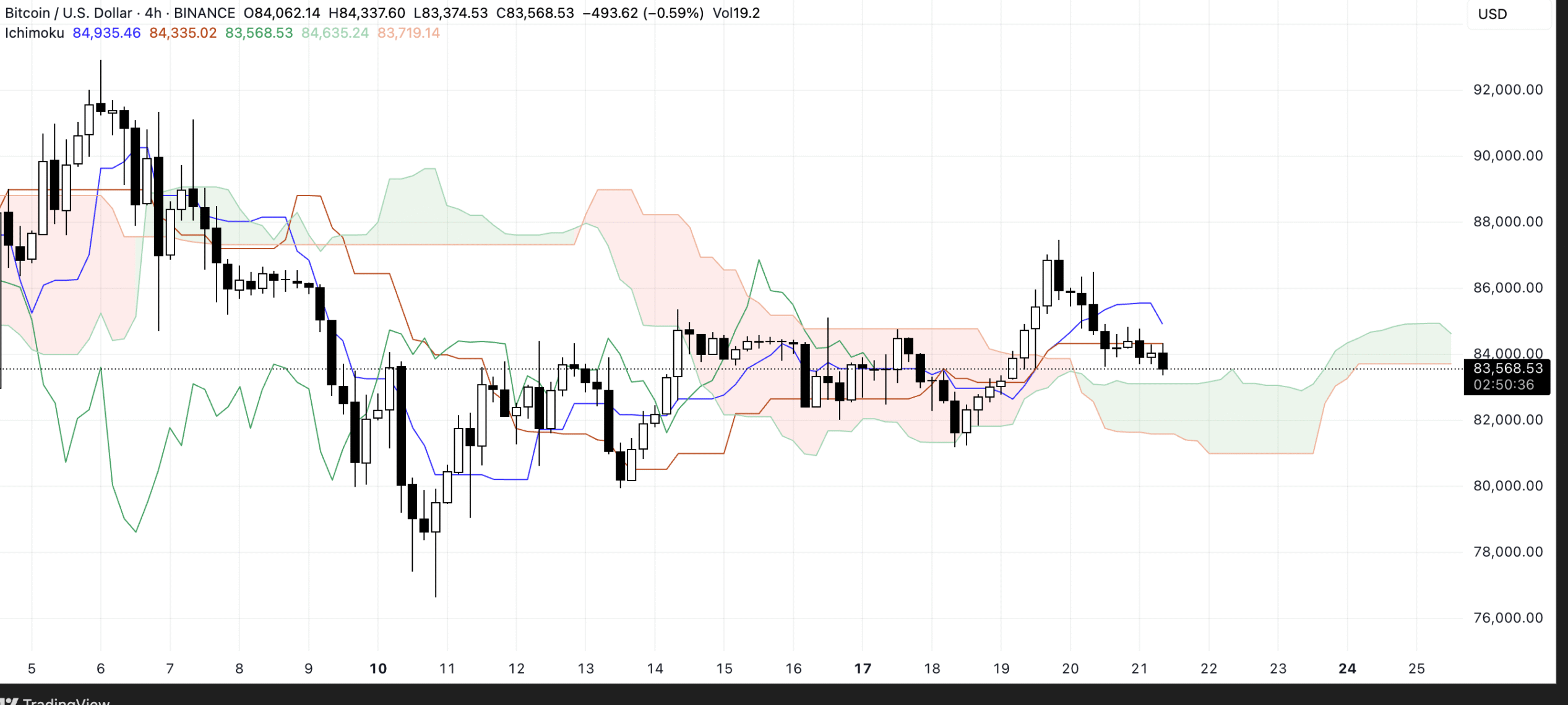

Bearish Market Signals

The whale activity clearly changed the attitude of the market right away. Technical indications began to indicate what traders feared as social media buzz grew negative. Relative Strength Index (RSI) readings indicated possible increased selling pressure while the Moving Average Convergence Divergence (MACD) went into negative territory.

Add to that the count of active XRP wallets started to drop. Usually indicating reduced liquidity, this decline in user activity and involvement can aggravate price volatility. Perhaps waiting to see how the market responds in the next days, retail investors seem to be retreating.

Ripple Supply Concerns

Making problems worse, this time around Ripple’s regular XRP unlocking from escrow attracted more attention. Releasing roughly 100 million tokens, valued at roughly $283 million, they ended up in an unidentified wallet. Though Ripple has previously clarified that this money is usually used to assist liquidity and ecosystem development, the timing couldn’t have been worse.

XRP was already under demand; therefore, worries about this newly discovered supply also finding its way into the open market, thereby lowering prices. It reminds us of the ongoing worries about token supply control and openness that have dogged XRP historically.

XRP Trend Reversal

Technically, XRP’s chart exhibits indicators of stress. From late February, the token has broken below an ascending channel it had been trading in. Often a bearish indication that suggests a trend change and the beginning of a more thorough decline.

The next definite help comes around at $1.65. Should the price fail to recover over $2 shortly, traders could witness a flood of stop-loss orders and panic selling, therefore driving XRP down below its present value. For weeks XRP has had a firm floor; a definitive closing below the $2 level on big volume could indicate a notable trend reversal.

Whale Accumulation Split

Fascinatingly, not all whales are leaving ship even in the panic. Furthermore, shown by on-chain analytics was the accumulation of some of the biggest XRP holders throughout the drop. Over 440 million tokens were added to wallets holding between 1 million and 100 million XRP within the past week—worth almost $1 billion.

This points to a whale community split. Some big investors are dumping tokens—perhaps for profit or hedging against future market or regulatory risks—while others are plainly seeing this as a purchasing opportunity. These growing whales could be relying on a long-term resurgence, or they could have inside confidence about forthcoming good news about Ripple or its continuous legal challenges.

XRP Price Volatility

So, is the $2 support level truly in danger? All signs point to continued volatility in the short term. If XRP fails to reclaim the $2.20-$2.30 zone in the next few trading sessions, it’s likely that the bearish momentum will continue, increasing the chances of a deeper correction.

However, should XRP manage to stabilize and whale accumulation persist, it’s possible the asset could consolidate above $2 before attempting a new leg upward. Everything now hinges on whether retail investors regain confidence and whether institutional sentiment follows suit.

Final thoughts

The $800 million whale sell-off of XRP has obviously shaken the market, endangering a crucial support level and throwing doubt on the near-term direction of the asset. Still, XRP might bounce back, given some whales are moving in to accumulate and the crypto market is known for its rapid reversals. Right now, prudence still rules the game; all eyes are on whether the $2 floor will hold.