Bitcoin Whale Shorts $521M Amid Volatility

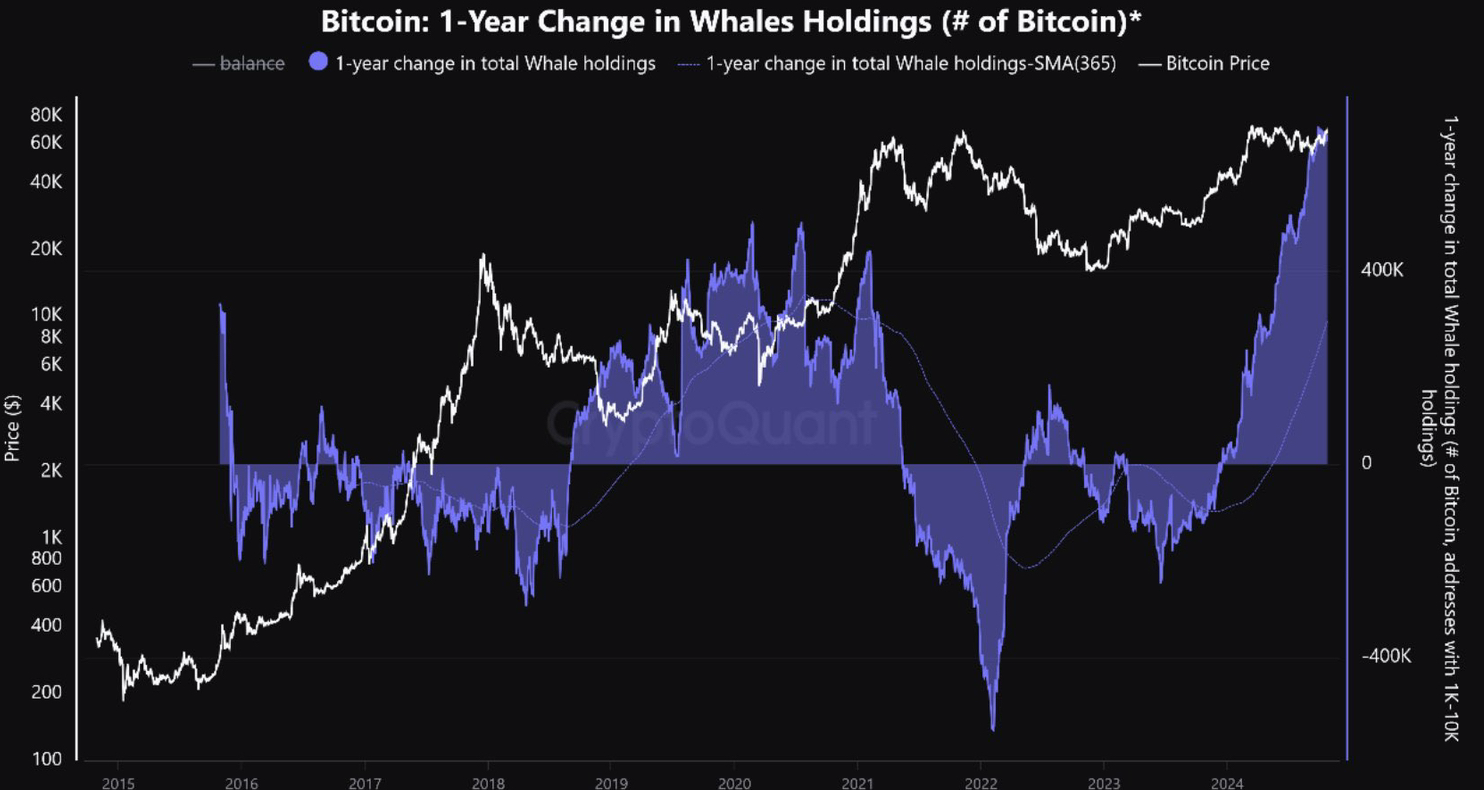

Large-scale actions in the ever-changing realm of cryptocurrencies are always under examination, particularly when they involve “whales”—people or organizations possessing significant Bitcoin quantities. For speculators hoping to profit from the market’s volatility, a $521 million short position on Bitcoin has lately attracted the most attention. With its highly leveraged posture, the whale has started a fight among crypto traders, who are currently working together to use Bitcoin’s price to set off a liquidation event.

This is a perfect illustration of how market players are always looking for opportunities to take advantage of one another’s positions. The results of such moves could be really significant.

Bitcoin Whale Shorts $521M

A Bitcoin whale valued at an amazing $521 million has taken an extremely short position in the centre of this high-stakes game. Under a short position, one borrows an asset—in this case, Bitcoin—to sell it at the present market price and subsequently purchase it back at a reduced cost to benefit from the difference. The whale employed 40x leverage to maximize the returns, greatly raising the danger and the possible payoff.

The choice to adopt such a big short position coincides with significant volatility in Bitcoin. After rising to a January all-time high of $108,786, Bitcoin’s price has plummeted by 23%. The whale’s situation is still unstable despite the retreat; a modest rise in the cost of Bitcoin could cause the position to be sold off. The drama starts playing out here as other traders perceive a chance to drive a liquidation and get paid off.

Traders Target Whale

Aware of the whale’s leveraged short posture, traders have grabbed the chance to profit from it. Under the alias Cbb0fe, these traders want to raise the price of Bitcoin by at least 1.75%. This would set off the whale’s short position’s liquidation, automatically closing it, and result in the whale having to pay back the borrowed Bitcoin at a higher price, suffering a large loss.

About $85,591 is the intended price for Bitcoin, a little rise from its present price of $84,108. Still, given the size of the position, even a minor price fluctuation can have major effects. These dealers have combined over $10 million in funds to help with this price rise. Purchasing Bitcoin allows them to generate sufficient upward price pressure to initiate the liquidation and maybe set off a chain reaction that would increase the price even more.

Bitcoin Whale Risks

The search for this $521 million Bitcoin whale emphasizes the inherent dangers of leveraged trading. Leverage exposes traders to far more risk even if it helps them increase their possible gains. In this instance, should Bitcoin’s price go against the whale’s position by a somewhat minor degree, their stake could be sold. Should the whale’s position be sold, the loss might be significant, and the knock-on effects might rock the market.

The whale has utilized 40x leverage; hence, even a 2.5% price movement against their position could cause liquidation. Under such circumstances, the whale would have to close its position at a loss, affecting the larger market. The size of the stake means that its liquidation might cause a significant change in the price of Bitcoin, generating volatility in the crypto markets.

Whale Trading Dynamics

The fact that the whale’s short position is on a distributed exchange (DEX), Hyperliquid, adds even more fascination to this scenario. Decentralized platforms, unlike conventional exchanges, give merchants the option to carry out transactions free from middlemen. This creates layers of complexity even when it has benefits, including more autonomy and fewer legal restrictions.

Higher leverage made possible by decentralized exchanges lets the whale know exactly what she has used. Still, they carry special hazards as well. For example, the price may fluctuate more violently if the platform lacks sufficient liquidity or market depth, therefore increasing the effect of any price changes. In this circumstance, the nature of the DEX can magnify the efforts of the traders to raise the price of Bitcoin, thereby generating an even more erratic situation.

Whale Market Dynamics

The circumstances behind this $521 million Bitcoin price whale perfectly illustrate the merciless character of crypto markets. Whales and traders both engage in ceaseless strategic battles, employing all kinds of tactics, including leverage, to profit from market swings. The whale’s position and the initiatives to sell it highlight how a mix of technical research, market psychology, and occasionally manipulation drives the bitcoin market.

This gives traders hoping to compel a liquidation a chance to profit from the whale’s vulnerability. Should they be successful, the whale’s misfortune will be rather profitable. The traders who have gambled on liquidation may suffer major losses if the whale’s posture maintains and Bitcoin’s price stays rather steady or even falls.

Final thoughts

The search for the $521 million Bitcoin whale reflects the more general dynamics in the crypto prices. The market is more than a tale of traders fighting for profit. The market is ready for volatility and manipulation, given that the price of Bitcoin is always changing and high-leverage tactics are in demand. Though it offers a chance for traders, the search for liquidation also reminds them of the dangers involved in such high-stakes trading.

Whether or not the whale’s position will be sold is still to be seen; the struggle for domination in this high-stakes game is certain to endure.